Best Hyperliquid RPC Providers 2026: Full Comparison

Compare the top 6 Hyperliquid RPC providers for HyperCore and HyperEVM. Pricing, gRPC streaming, features, and compliance compared side-by-side.

If you're building on Hyperliquid right now, you already know the public RPC won't cut it. Since August 2025, the public endpoint has been capped at just 100 requests per minute. For a chain regularly processing billions in daily perp volume with sub-second finality, that limit means you need private RPC infrastructure from day one.

But choosing a Hyperliquid provider isn't as simple as picking the cheapest option. Hyperliquid's dual-layer architecture, with HyperCore handling the native L1 order book and HyperEVM running Ethereum-compatible smart contracts, means you need to think carefully about which layer (or both) your application actually needs. Not every provider supports both, and the ones that do offer very different levels of depth.

We looked at the five providers currently offering production-grade Hyperliquid RPC: Quicknode, Alchemy, Chainstack, Dwellir, HypeRPC by Imperator and Hydromancer. Here's how they compare as of February 2026.

Why Hyperliquid infrastructure is different

Before jumping into the providers, it helps to understand what makes Hyperliquid's RPC requirements unique compared to other chains.

Hyperliquid is the dominant decentralized perpetual futures exchange, holding roughly 62% of all perp DEX open interest with daily perp volumes that have ranged from $4B to $8.9B in recent months (and spiking well above that during major market events). The HYPE token sits at around #12 by market cap (~$8.2 billion), and the protocol has seen a string of major catalysts recently: HIP-3 launched permissionless perp markets in October 2025, HIP-4 is bringing prediction markets to testnet, Ripple Prime integrated institutional brokerage connectivity on February 4, Coinbase listed HYPE on February 5, and 21Shares filed for a HYPE ETF.

What matters for infrastructure is the architecture. HyperCore is a custom Rust-based execution environment that handles all order-book operations with ~0.2-second finality and throughput of around 200,000 orders per second. HyperEVM, which went live on mainnet on February 17, 2025, runs standard Ethereum smart contracts under the HyperBFT consensus, with a dual-block design (1-second small blocks, 60-second large blocks).

Providers need to support both layers, multiple protocols (HTTP, WebSocket, and ideally gRPC), and up to seven distinct HyperCore data streams including trades, orders, book updates, TWAP, events, blocks, and writer actions. One important caveat: no private RPC provider can access proprietary HyperCore trading methods like order placement and cancellation. Those still route exclusively through Hyperliquid's public API at api.hyperliquid.xyz.

Quicknode: full HyperCore + HyperEVM with the broadest protocol support

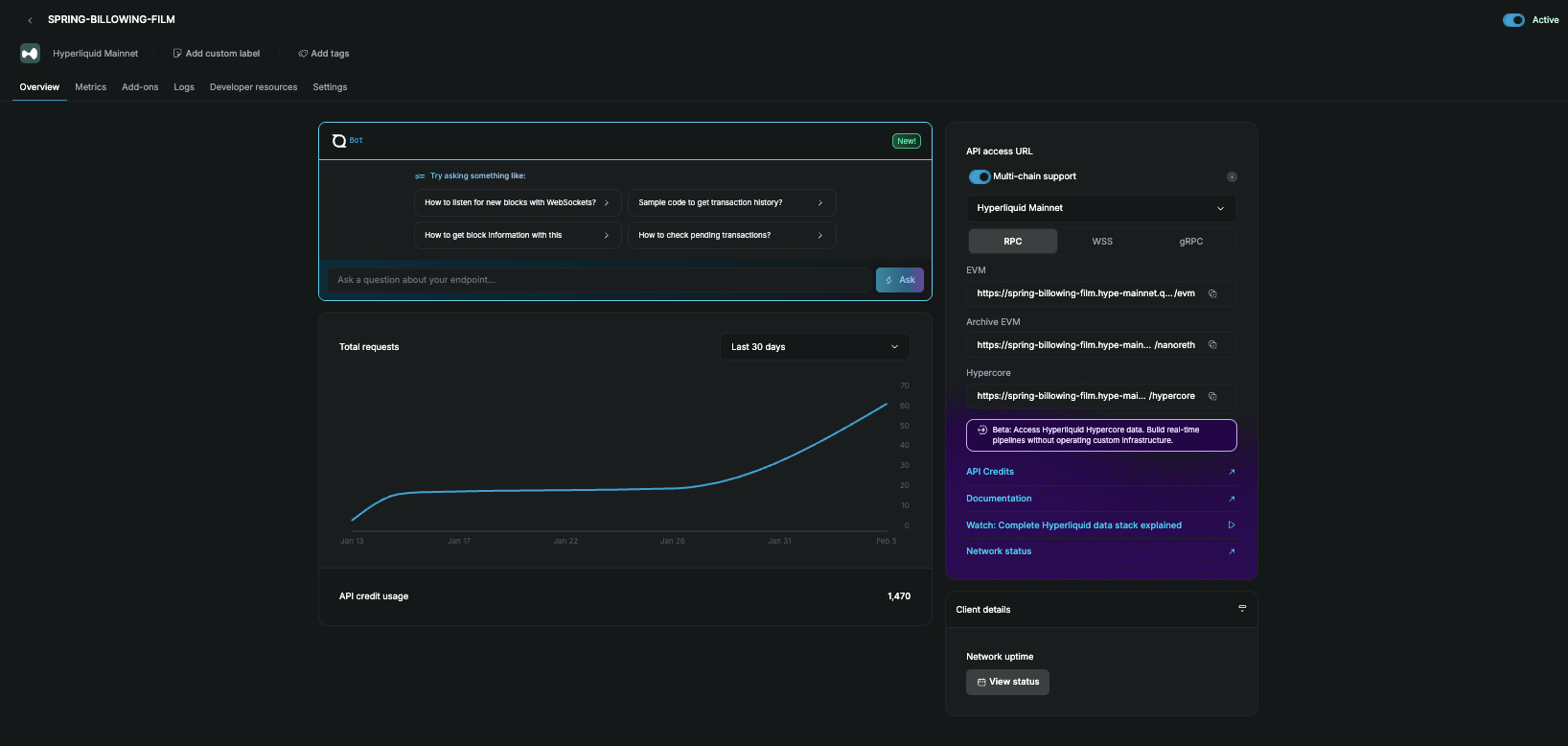

Quicknode entered the Hyperliquid ecosystem in mid-2025 and launched the HyperCore public beta on January 20, 2026. This is the key differentiator: Quicknode delivers all seven HyperCore data streams through gRPC, Streams, JSON-RPC, and WebSocket, all from a single unified endpoint that also serves HyperEVM. No other managed infrastructure provider offers this breadth of HyperCore coverage.

HyperCore is where the trading happens. It processes 200,000 orders per second and billions in daily volume. Quicknode gives you access to all seven native data stream types: trades (every fill in real-time), orders (placement and cancellation events), book updates (L2 order book deltas), TWAP (time-weighted average prices), events (liquidations, funding), blocks (full block data), and writer actions (onchain write operations).

The gRPC interface supports bidirectional streaming with native zstd compression (roughly 70% bandwidth reduction) and sub-millisecond latency. WebSocket provides real-time streaming for six data types. JSON-RPC and HTTP support historical queries, with up to 200 blocks per request. And Streams gives you filtered, push-based delivery so you can subscribe per market or event type instead of ingesting the full Hyperliquid data firehose and filtering downstream.

For HyperEVM, Quicknode serves two endpoint paths: /evm for standard Ethereum JSON-RPC (compatible with Foundry, Hardhat, Web3.js, Ethers.js, and Viem) and /nanoreth for an extended historical archive with full debug and trace methods, plus WebSocket access. You can also deploy smart contracts and read HyperCore oracle prices directly onchain.

HyperCore beta access is included on all paid plans (Build and above) with no add-on required. Usage is metered in API credits based on data volume, with Hyperliquid-specific credit multipliers documented at quicknode.com/api-credits/hyperliquid.

| Plan | Monthly Cost | Included API Credits | RPS Limit |

|---|---|---|---|

| Free Trial | FREE (1 month) | ~10M | ~15 |

| Build | $49 | ~80M | ~50 |

| Accelerate | $249 | ~450M | ~125 |

| Scale | $499 | ~950M | ~250 |

| Business | $999 | ~2B | ~500 |

| Enterprise | Custom | Custom | Custom |

Overage rates run approximately $0.50 to $0.62 per million credits, depending on your plan tier, and annual billing gets you a 15% discount. On the compliance side, Quicknode holds SOC 1 Type II, SOC 2 Type II, and ISO 27001 certifications with a 99.99% uptime SLA. The platform supports 80+ chains, serves 700K+ developer accounts, and processed over 5 trillion requests in 2025 alone, with global routing across 14+ regions and 5+ cloud providers.

Quicknode has also published several Hyperliquid developer guides, including tutorials for building portfolio trackers and reading HyperCore oracle prices in HyperEVM, plus a protocol analysis that tracked Hyperliquid's rise to 76.7% perp DEX market share at its peak.

Alchemy

Alchemy focuses on HyperEVM. As of January 2026, Alchemy is an EVM-only provider for Hyperliquid and does not offer dedicated HyperCore infrastructure. Where Alchemy really stands out is its permanent free tier: 30 million compute units per month, which translates to roughly 1.2 million average requests at no cost. That's substantially more generous than any other provider on this list.

| Plan | Monthly Cost | Included CU | Throughput | Overage |

|---|---|---|---|---|

| Free | FREE | 30M CU | 1,000 CU/s | N/A (upgrade required) |

| Pay As You Go | $0 ($5 min purchase) | Usage-based | 10,000 CU/s | $0.45/M CU (drops to $0.40 after 300M) |

| Enterprise | Custom | Custom | Custom | Custom |

Alchemy uses a compute unit model where different methods cost different amounts: eth_blockNumber is 10 CU, eth_call is 26 CU, eth_getLogs is 60 CU, and eth_sendRawTransaction is 40 CU. At the average of about 25 CU per request, the effective cost on Pay As You Go works out to roughly $0.000011 per request.

The platform provides HTTP and WebSocket endpoints for HyperEVM mainnet and testnet, full archive data on all plans, debug/trace on PAYG and above, and Smart Wallet integration with email/social login and gas sponsorship. Alchemy holds SOC 2 Type II certification and claims 15x greater throughput than the public Hyperliquid RPC.

The trade-off is clear: Alchemy does not offer gRPC streaming or dedicated HyperCore infrastructure for Hyperliquid. If you're building a DeFi app on HyperEVM and want to keep costs low during development, Alchemy is a great starting point. If you need HyperCore data for trading or analytics, you'll need to look elsewhere.

Chainstack

Chainstack launched Hyperliquid support on May 20, 2025 and offers a straightforward pricing model of the bunch: 1 API call equals 1 request unit, regardless of which method you're calling. No credit multipliers, no variable weights. If you're scaling a Hyperliquid workload where your request mix changes over time, this makes cost estimation really simple.

| Plan | Monthly Cost | Included Requests | Approx. RPS | Overage |

|---|---|---|---|---|

| Developer | FREE | 3M | ~25 | $20/M |

| Growth | $49 | 20M | ~250 | $15/M |

| Pro | $199 | 80M | ~400 | $12.50/M |

| Business | $349 | 140M | ~600 | $10/M |

| Enterprise | From $990 | 400M | Custom | From $5/M |

The only exception: archive node requests cost 2 request units instead of 1. Chainstack also offers an Unlimited Node add-on starting at $149/month that removes per-request billing within your RPS tier, and dedicated nodes at $0.50/hour with unmetered requests.

Chainstack supports both HyperEVM and offers HyperCore info queries (account data, fills, market metadata) but does not provide dedicated gRPC streaming infrastructure. You get HTTP and WebSocket endpoints, archive nodes, and debug/trace APIs. It does not offer gRPC streaming for Hyperliquid. Some nice extras include a built-in testnet faucet (1 HYPE per 24 hours, no Twitter auth required), an HyperEVM method availability table tracking 100+ methods with live status, and an MCP Server with "Mastering Hyperliquid" best practices.

Compliance is solid: SOC 2 Type II and ISO 27001, with a 99.99% uptime SLA on dedicated nodes. Chainstack has also published more Hyperliquid content than any other provider, with eight blog posts and tutorials covering trading bot guides, onchain activity trackers, and their own provider comparison.

Dwellir

Dwellir is a Swedish company (founded 2021, based in Uppsala) that has built what is probably the most specialized Hyperliquid infrastructure of any multi-chain provider. Their offering goes well beyond standard RPC to include dedicated gRPC streaming, an L2/L4 order book server, co-located execution environments, and historical data archives.

Their general RPC platform uses a clean 1:1 pricing model starting at $5 one-time for Starter and $49/month for Developer. But their Hyperliquid-specific pricing is a separate, more granular structure:

| Service | Monthly Cost | Key Details |

|---|---|---|

| gRPC Streaming API | $699 + usage | Real-time HyperCore block streaming, trade/fill notifications, 24hr block retention |

| Order Book Server | $199 + usage | L2/L4 data, Singapore and Tokyo edge servers, sub-ms updates |

| Dedicated Node | $1,150 flat | Unmetered JSON-RPC + gRPC + order book bundled, unlimited RPS |

| Historical Data | Custom | Archival fills, replica commands, Parquet/S3 delivery |

The $1,150/month dedicated node is where things get interesting for high-volume users. It bundles HyperEVM JSON-RPC, HyperCore gRPC, and order book access with zero metering or rate limits. Worth noting: Dwellir's HyperCore gRPC offering includes three streaming endpoints (Blocks, Fills, and Orderbook) plus three unary query types, with a 24-hour data retention window and no native compression. By comparison, Quicknode's HyperCore beta delivers seven stream types with native zstd compression, filtered per-market push delivery via Streams, and full historical archive access. The trade-off is that Dwellir's order book server and co-located execution environments offer specialized trading infrastructure that Quicknode doesn't replicate.

Their order book server delivers 5x more depth than the public API (100 levels per side vs. 20), with L4 individual-order visibility including user addresses, order IDs, and timestamps. Edge servers in Singapore and Tokyo sit close to Hyperliquid's validator set, and they've benchmarked a 24.1% median latency improvement over the public feed across 2,662 trades. Co-located execution lets you run single-tenant VPS instances alongside dedicated Hyperliquid nodes, eliminating network round-trips entirely.

The main gap: Dwellir has no published compliance certifications (no SOC 2 or ISO 27001), which could be a blocker for institutional teams. They have published over 10 Hyperliquid-focused blog posts and tutorials, including guides for building liquidation trackers and copy-trading bots.

HypeRPC (by Imperator)

HypeRPC is operated by Imperator.co, a multi-chain validator operator. It launched on March 20, 2025. Currently focused on HyperEVM (HyperCore L1 support is under active development), HypeRPC differentiates through validator-backed infrastructure co-located near Hyperliquid validators, with servers in EU and Japan.

| Plan | Monthly Cost | Included CU | CU/s Limit | Uptime SLA |

|---|---|---|---|---|

| Starter | FREE | 2M CU | 100 | N/A |

| Professional | $99 | 200M CU | 1,000 | 99%+ |

| Enterprise | $299 | 620M CU | 3,000 | 99.5%+ |

| Unlimited | $499 | 1.1B CU | 6,000 | 99.9%+ |

| Dedicated | Custom | Unlimited | Custom | 99.99%+ |

HypeRPC switched to a compute unit model in September 2025. Overage rates are $0.50 per million CU in EU or $0.75 per million CU in Japan. The Japan region carries a 50% surcharge on plan pricing, which reflects its proximity to validators and the latency advantage that comes with it. They report average latency of about 40ms with demonstrated peak throughput of 45,000 RPS.

The company also hosts HLH, the first in-person Hyperliquid hackathon (held in Seoul), which shows real commitment to the ecosystem. Up to 20% discounts are available on 12-month billing.

The current limitation is the lack of public HyperCore support. HypeRPC has built HyperCore API endpoints that mirror the foundation's (1:1 mapping), but these don't appear to be publicly available yet. If your application only needs HyperEVM, HypeRPC is a solid Hyperliquid-focused option. If you need HyperCore data streaming today, you may need to pair it with another provider, though this gap could close as HypeRPC expands its offering

Hydromancer

Hydromancer BV is a Netherlands-registered HyperCore-native API and data platform built by the former HyperDash team (acquired by pvp.trade). While HypeRPC provides standard EVM RPC endpoints, Hydromancer provides enhanced HyperCore API schemas with unique endpoints you can't get anywhere else.

These include builderFills, batchClearinghouseStates (query 1,000+ wallets at once), liquidationFills, L4 orderbook streaming with address visibility, and a complete HIP-3 DEX data stack. Pricing starts at $300/month (Starter), scaling to $1,200 (Growth), $2,500 (Scale), and custom Enterprise tiers. No rate limits. Over 30 live apps depend on it, including HyENA, pvp.trade, Redstone, and tread.fi.

Hydromancer does not provide standard EVM RPC. It serves a different layer of the stack. Builders who need both HyperEVM RPC and rich HyperCore data would pair Hydromancer with a standard provider like Quicknode.

Pricing models compared: what you'll actually pay

The five providers use three fundamentally different pricing approaches, and which one works best depends entirely on your workload.

Credit/CU-based models (Quicknode, Alchemy, HypeRPC) assign variable weights to different API methods. A simple eth_blockNumber call might cost 10 CU on Alchemy while a debug_traceTransaction costs far more. Your workload composition determines your effective cost: a read-heavy DeFi dashboard burns through credits much more slowly than a debugging-intensive dev workflow.

Flat request-based models (Chainstack, Dwellir's general platform) count every call equally. eth_call and eth_getLogs both cost exactly 1 request unit on Chainstack (archive requests are the one exception at 2x). This makes billing predictable and simple.

Specialized tiered models (Dwellir's Hyperliquid pricing, Hydromancer) charge flat monthly fees for specific data products like gRPC streaming and order book servers. Dwellir's $1,150/month dedicated node with unlimited everything is the simplest option for high-volume users who want to stop worrying about per-request costs.

For a typical Hyperliquid trading bot making 10 million requests per month (mostly eth_call, eth_getBalance, and WebSocket subscriptions), here's roughly what you'd pay:

- Quicknode Build: ~$49 (credit consumption depends on method multipliers)

- Chainstack Growth: $49 (20M requests included)

- Dwellir Developer: $49 (25M requests included)

- HypeRPC Professional: $99 (200M CU included, plenty of headroom)

- Alchemy PAYG: ~$100 to $115 (at ~25 CU average)

For high-volume HyperCore data pipelines requiring gRPC streaming, the field narrows fast: Quicknode (included on all paid plans via HyperCore beta), Dwellir ($699/month + usage or $1,150 dedicated), and eventually HypeRPC (under development).

Feature comparison at a glance

| Feature | Quicknode | Alchemy | Chainstack | Dwellir | HypeRPC |

|---|---|---|---|---|---|

| HyperEVM | Yes | Yes | Yes | Yes | Yes |

| HyperCore (L1) | Full (7 streams, zstd) | EVM only | Info queries only | 3 streams, 24hr retention | API endpoints built (not yet public) |

| gRPC Streaming | Yes (zstd compression) | No | No | Yes (no compression) | No |

| Filtered Push Delivery (Streams) | Yes (per market/event) | No | No | No | No |

| Historical Archive + Tracing | Yes (full, via /nanoreth) | Limited | Varies | 24hr window | Not confirmed |

| Unified HyperCore + EVM Endpoint | Yes | N/A | N/A | Separate | Yes (not yet public) |

| WebSocket | Yes | Yes | Yes | Yes | Yes |

| Archive Data | Yes (via /nanoreth) | Yes (all plans) | Yes (2x RU) | Yes (custom pricing) | Yes |

| Free Tier | Yes (1-month free trial) | Yes (30M CU/mo) | Yes (3M req/mo) | No ($5 one-time) | Yes (2M CU/mo) |

| Lowest Paid Plan | $49/mo | $0 (PAYG) | $49/mo | $49/mo (general) | $99/mo |

| Dedicated Nodes | Yes (Enterprise) | Yes (Enterprise) | Yes ($0.50/hr) | Yes ($1,150/mo) | Yes (Custom) |

| Order Book Data | Via gRPC streams | No | No | Yes (L2/L4, 5x depth) | No |

| SOC 2 Type II | Yes | Yes | Yes | No | No |

| ISO 27001 | Yes | Not confirmed | Yes | No | No |

| Uptime SLA | 99.99% | 99.9%+ (99.99% Enterprise) | 99.99% (dedicated) | 99.9%+ | 99% to 99.99% (by plan) |

| Regions | 14+ global | Global | US, EU, Asia | Singapore, Tokyo | EU, Japan |

| Testnet | Yes (with faucet) | Yes | Yes (with faucet) | Not confirmed | Not confirmed |

Which provider should you pick?

It depends on what you're building.

If you're building trading infrastructure, market-making systems, or real-time analytics that need HyperCore data, Quicknode gives you the most complete package: seven HyperCore data streams with native zstd compression, filtered per-market push delivery via Streams, gRPC with sub-millisecond latency, and full historical archive access, all through a unified endpoint that also serves HyperEVM. The HyperCore public beta is included on all paid plans starting at $49/month with no add-on. For teams that need enterprise compliance (SOC 1, SOC 2, ISO 27001) and a 99.99% uptime SLA backed by 5T+ requests served in 2025, it's the most production-ready option. Dwellir is worth considering if you specifically need L4 order book depth and co-located execution in Singapore or Tokyo, though their HyperCore gRPC is more limited (3 stream types, 24hr retention, no native compression) compared to Quicknode's full offering.

If you're building trading infrastructure, analytics, or anything that needs HyperCore data, Quicknode is the only provider that delivers all seven HyperCore data streams with gRPC, Streams, JSON-RPC, and WebSocket from a single unified endpoint. HyperCore access is available on Build plans and above, starting at $49/month, and the platform includes enterprise compliance (SOC 1, SOC 2, ISO 27001), a 99.99% uptime SLA, and a testnet faucet for development. For most Hyperliquid builders, this covers the full stack.

If you're early-stage and want to prototype on HyperEVM at zero cost, Quicknode's free trial gives you a month to build and test on HyperEVM. To unlock HyperCore data streams via gRPC and Streams, you'll need the Build plan at $49/month.

If your workload spans both layers, Quicknode is the only provider with a unified endpoint serving HyperCore and HyperEVM together. No juggling multiple providers, no stitching together separate pipelines. One endpoint, full coverage.

If you need enriched HyperCore API schemas like batch wallet queries or liquidation fills beyond standard RPC, platforms like Hydromancer serve that layer and pair well alongside Quicknode as your core infrastructure.

About Quicknode

Founded in 2017, Quicknode provides world-class blockchain infrastructure to developers and enterprises. With 99.99% uptime, support for 80+ blockchains, and performance trusted by industry leaders, we empower builders to deploy and scale next-generation applications across Web3.

Start building today at Quicknode.com