Decentralized Exchange (DEX) Stats

This week we’re taking a look at data for Ethereum DEXs. If you are into crypto, then you’re probably familiar with Decentralized Exchanges and Protocols. Let’s explore how Ethereum’s DEX ecosystem is performing now!

DEX protocols, exchange trades, and market share

This week we’re taking a look at data for Ethereum DEXs. If you are into crypto, then you’re probably familiar with Decentralized Exchanges and Protocols. Let’s explore how Ethereum’s DEX ecosystem is performing now!

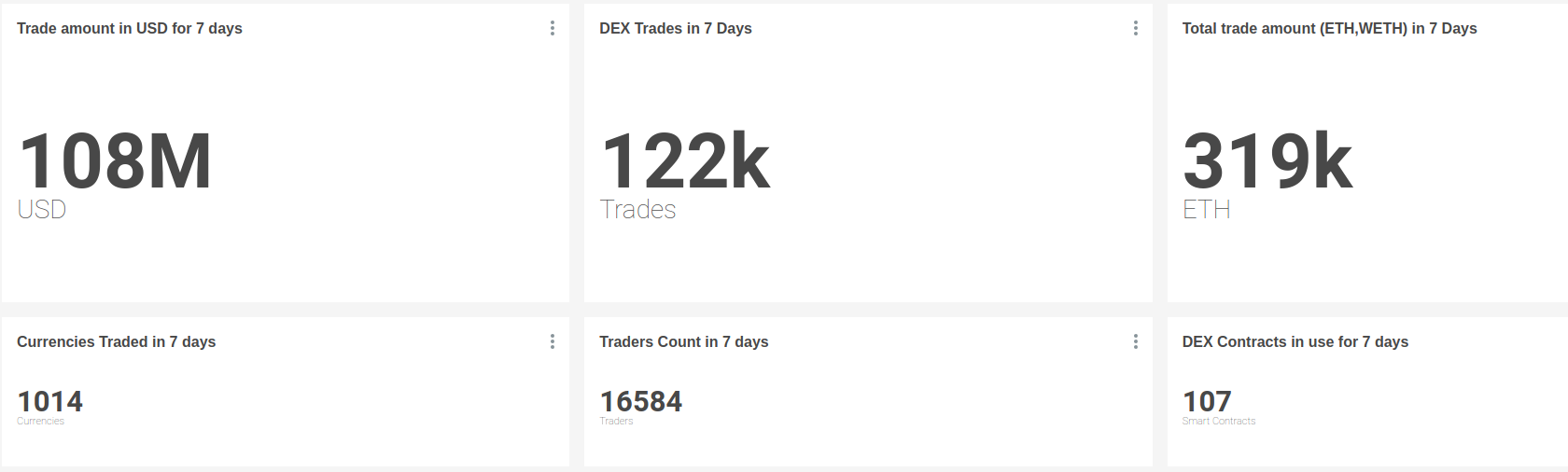

Where CEXs (Centralized Exchanges) have Trillions of dollars (USD) in monthly volume, DEXs are still struggling with liquidity. For example, in the last 7 days, DEXs had 108 Million dollars in volume. Compare this to CEX’s more than 80 Billion dollars 24-hour volume 😳

Terminology

- DEX protocol — a protocol supporting multiple tokens with order books (e.g. 0x protocol)

- DEX — a stand-alone Decentralized Exchange

- Token Swap Service — Swap tokens without order books (e.g. Uniswap, Kyber), or assist in only 1 single pair trade (Eth2Dai) with order books.

Tl:dr;

- IDEX is a clear winner in DEX trading volume

- Token swap protocols are doing better

- DEX protocols (such as 0x) having a hard time in terms of adoption

Note →Data shows “Market Matching Protocol” which is “OasisDex” and now it’s Eth2Dai.

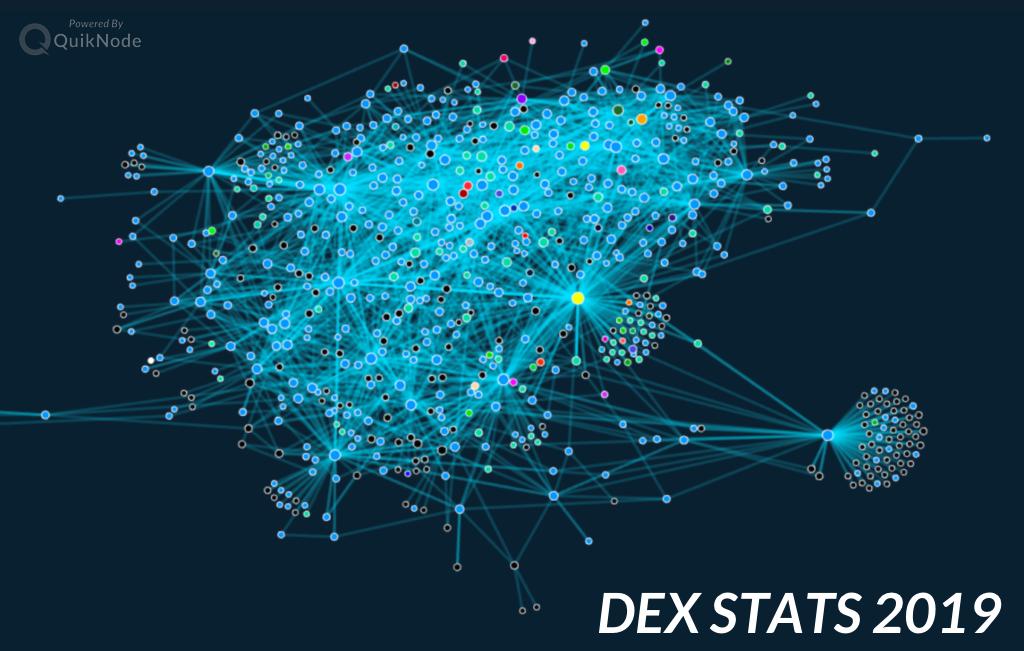

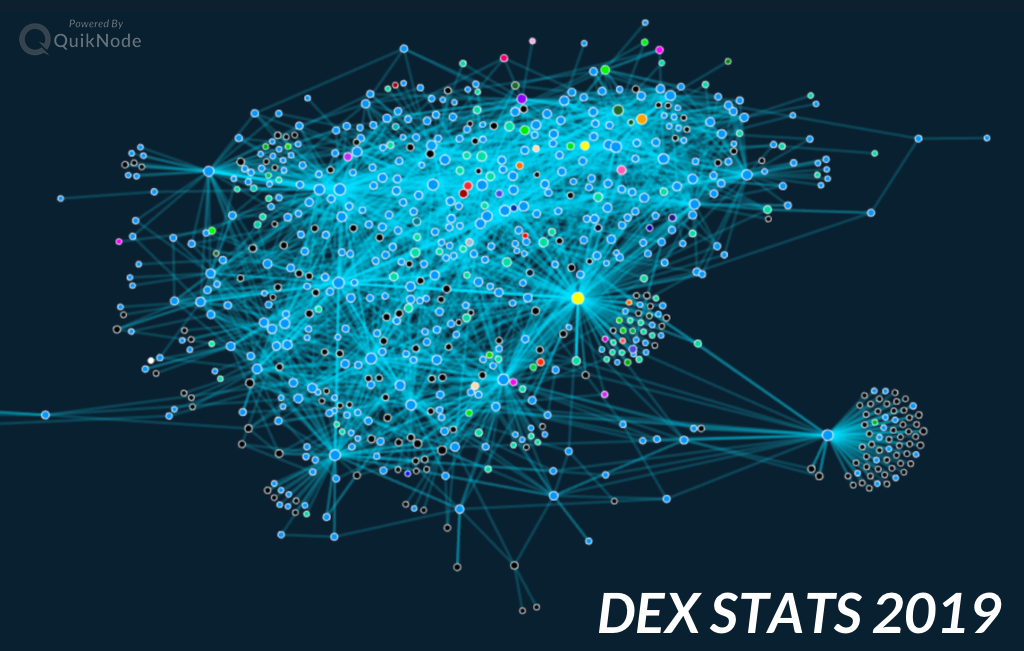

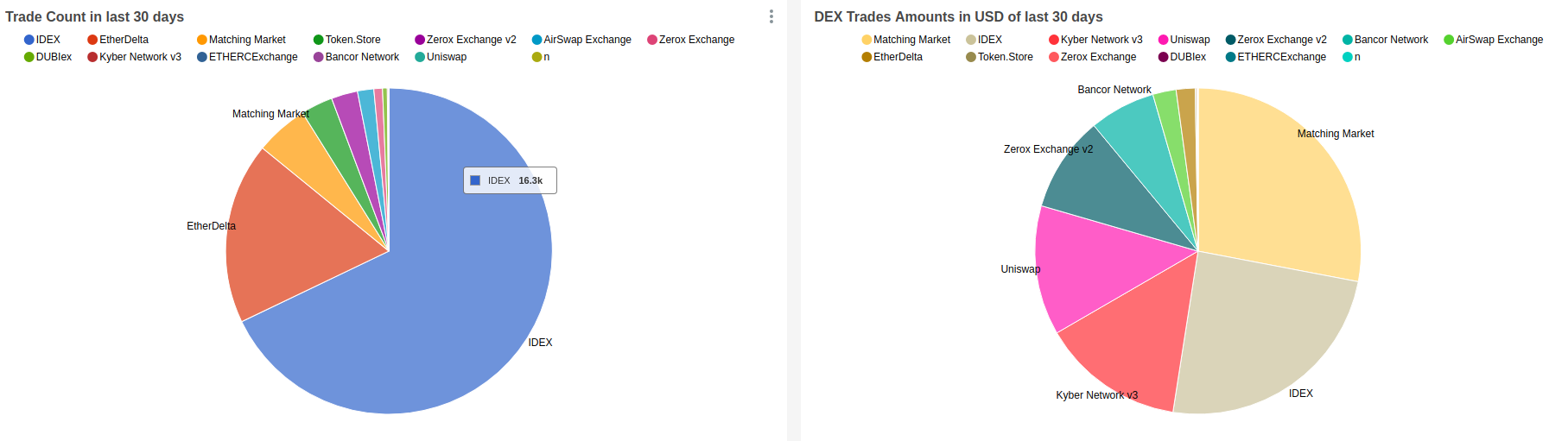

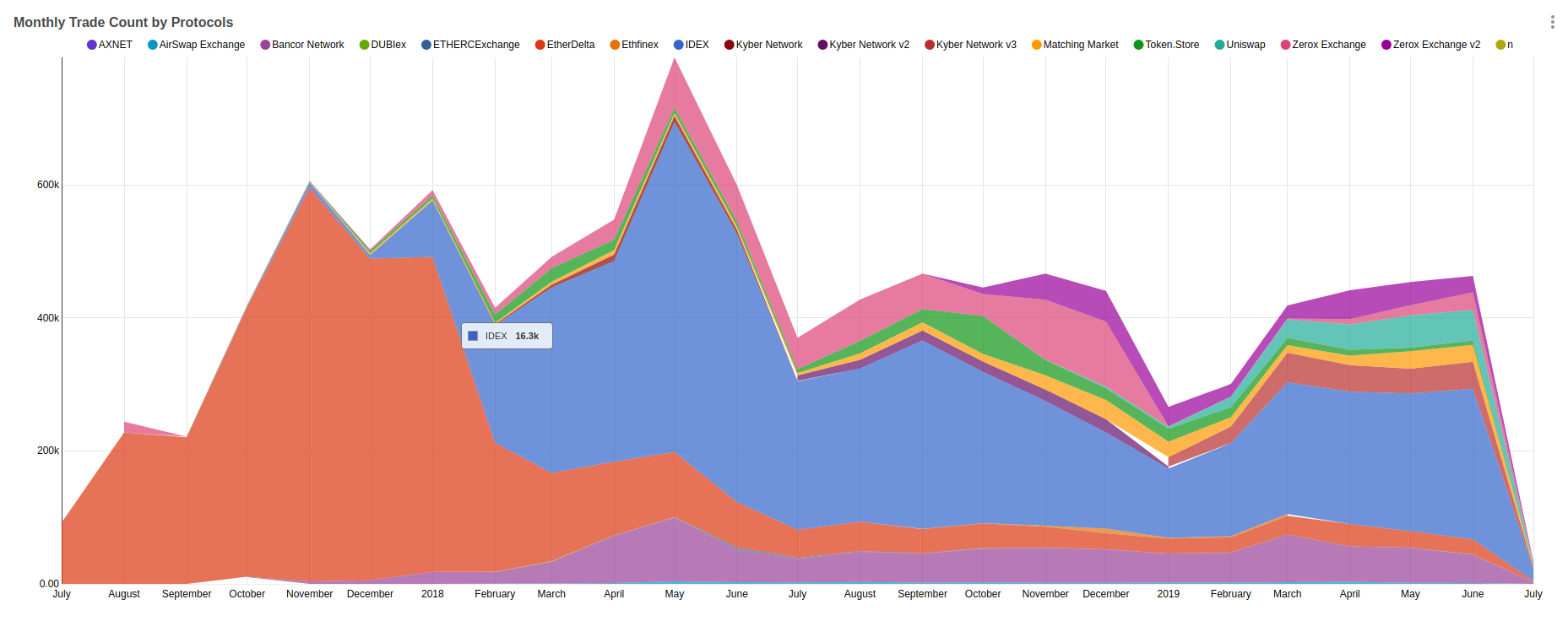

Trade Distribution Among Different Ethereum Exchanges

IDEX takes a clear lead when it comes to the number of trades among different exchanges. IDEX is a semi-DEX — with off-chain order books & order matching, and on-chain settlement. But when it comes to Trade amount, Matching Market (Which is Eth2Dai) are doing better than IDEX. As the name suggests, Eth2Dai only facilitates ETH ↔️ DAI exchange. This shows that a lot of traders are converting their Ether into Dai Stablecoin, and vice versa.

Trade Distribution Among Different Ethereum Protocols

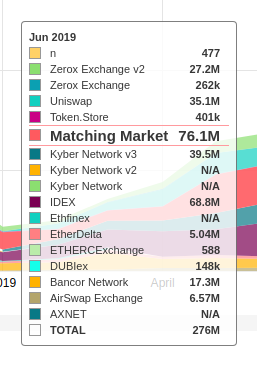

Here, IDEX also takes the lead, but token swap protocols like Uniswap, Bancor and Kyber are also getting good traction. However, most of these services are not actually DEXs, as they do not host order books. Overall, DEX protocols (like 0x protocol) are still having a hard time gaining adoption.

In Terms of the USD amount clearly, ETH ↔️ DAI pair is a clear winner with 76 Million USD in volume. The real contrast here is that among the top 4, there are 3 token swap services (Eth2Dai, Uniswap, Kyber), and IDEX is the only actual “DEX”. 0x is in 5th place with 27 Million in volume.

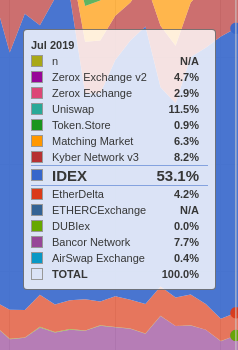

Market Share

IDEX holds more than 50% market share. Various token swap services hold around 33% market share. Two different versions of 0x protocol hold only ~7.6% market share. This shows that there is good demand for token swap services as they are more secure, cheaper and reliable than centralized token swap services like Shapeshift and Changelly.

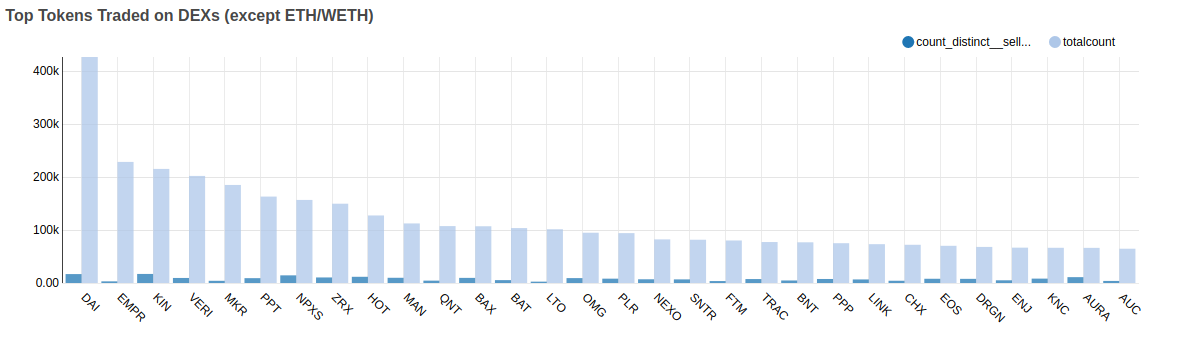

Top Tokens Traded on DEX (excluding ETH/WETH)

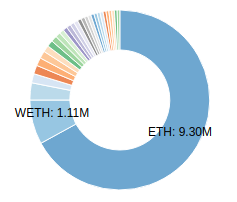

The major currency traded is Ether and its derivative tokens — ETH and WETH. The most common transaction is an exchange of Ether (in the form of a token or ETH currency) to or from another token.

Other than ETH and WETH, Dai is the top-traded coin on DEXs. One more interesting fact is that around 15% of all trades on DEXs involves tokens which are not listed on any CEX, only on these DEXs. Example, EMPR is only listed in 3 exchanges — of which 2 are DEXs.

Note: Dai volume doesn’t indicate that Dai is getting used for trading, this data involves Eth2Dai.

Conclusion

The data above shows that even after 2 years and millions of dollars in funding, decentralized exchange protocols are still fighting to overtake CEXs and offer the same level of functionality, liquidity, and service. That said, there is progress; token swap protocols are doing better and gaining traction.

If you’ve ever used Uniswap or Kyber, you will clearly see the difference how making a token swap service decentralized leads to a better user-experience and efficient exchange. But this is not true in case of DEXs. We need Decentralize Exchanges to integrate efficient market making and Algo trading software without wasting a ton of money on Gas (cost of making a change to the Ethereum blockchain). Eth2.0’s features aim to help DEX protocols in terms of transaction throughput and cost.

IDEX is a clear winner because of its semi-centralized/decentralized model, where you need to deposit tokens on IDEX’s Smart Contract w/ settlements on-chain, but everything else goes from IDEX’s centralized servers and database.

Decentralized Protocol projects such as 0x (ZRX) and Loopring (LRC) have been working hard. Recently, Loopring patented several solutions for the front-running problem and introduced zkSnarks to increase transaction throughput (in an effort to solve the liquidity problem). The 0x team is also experimenting with Starks to solve the liquidity problem. We think that with time, these projects will solve these problems and continue to move DEXs towards the same functionality and efficiency of CEXs.

Decentralization is not the value proposition and projects already understand it. You can’t sell inefficient products in the name of idealist values, no one cares 🧐

#DeFi is on the Move

Decentralized Finance is growing exponentially and we’ll dig more into DeFi stats in the next article, so make sure you subscribe to our newsletter below!

Data source — Bloxy

Need help with your project or have questions? Contact us via this form, on Twitter @QuickNode, or ping us on Discord!

About QuickNode

QuickNode is building infrastructure to support the future of Web3. Since 2017, we’ve worked with hundreds of developers and companies, helping scale dApps and providing high-performance access to 16+ blockchains. Subscribe to our newsletter for more content like this and stay in the loop with what’s happening in Web3! 😃