Ethereum Ecosystem Statistics

Today, we will look into Ethereum statistics and see what happened in 2018–2019; what worked, what didn’t, and what’s coming next 🚀🌖🙌

What happened in 2018/2019 & where we are going!

Today, we will look into Ethereum statistics and see what happened in 2018–2019; what worked, what didn’t, and what’s coming next 🚀🌖🙌

tl;dr

- Less ICO buzz 📄

- High Smart Contract creation, usage, and growing developer adoption 📝

- ERC20 still dominates as a token standard ⚙

- More DApps, but w/ limited user adoption (yet!) 🛠

- #DeFi is on the move 📈

As Bitcoin’s price rose in 2017, everyone wanted a coin and Ethereum was ideally placed for this situation. Anyone could build a token on the Ethereum blockchain in less than an hour, and opportunists did exactly that — shouting for the tokenization of everything from the top of the Eiffel Tower (many without a legitimate use-case, real understanding of blockchain technology, token economics, incentivization, or decentralization… [yes, I am cynical about ICOs now and I dislike them, #opinion]).

There were all sorts of useless coins and Ethereum became a token-making machine. In this crazy town however, a few projects started which weren’t focused on tokens, but rather using Ethereum’s Smart Contract technology and building real, decentralized applications (dApps).

As the bear market of 2018 crushed the crowd sale trend and tested the strength & durability of many blockchain projects, it’s refreshing to say that developers are now building some awesome, usable dApps 😃!

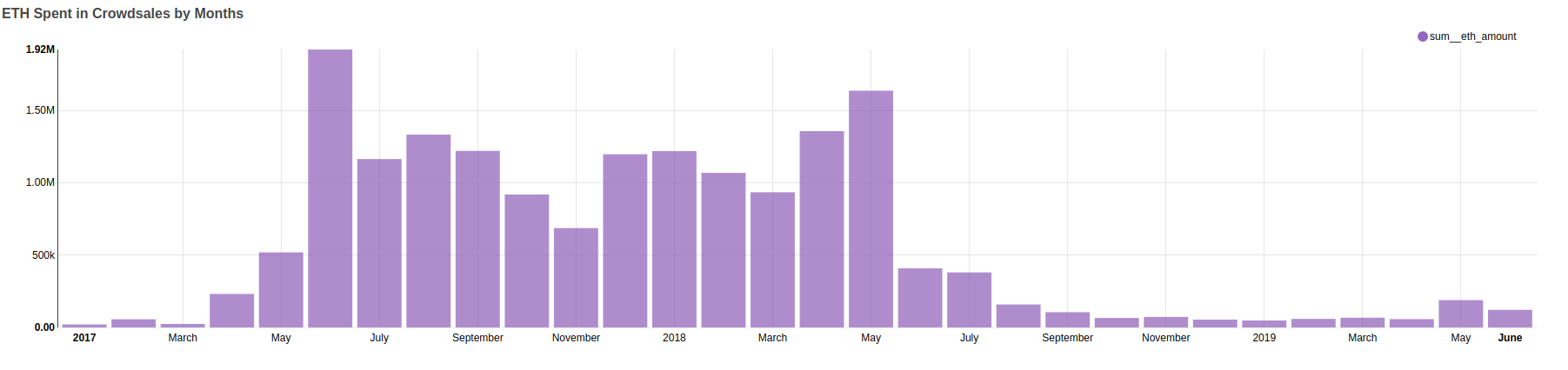

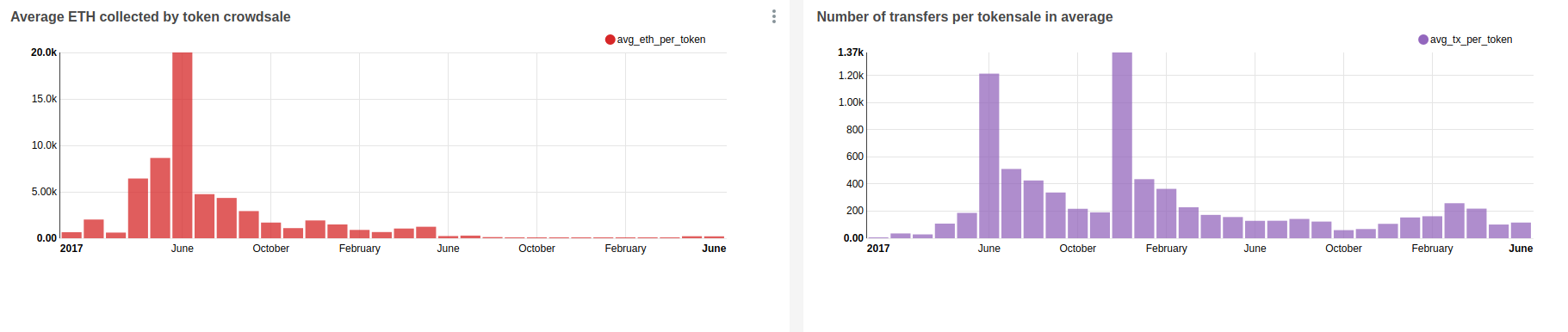

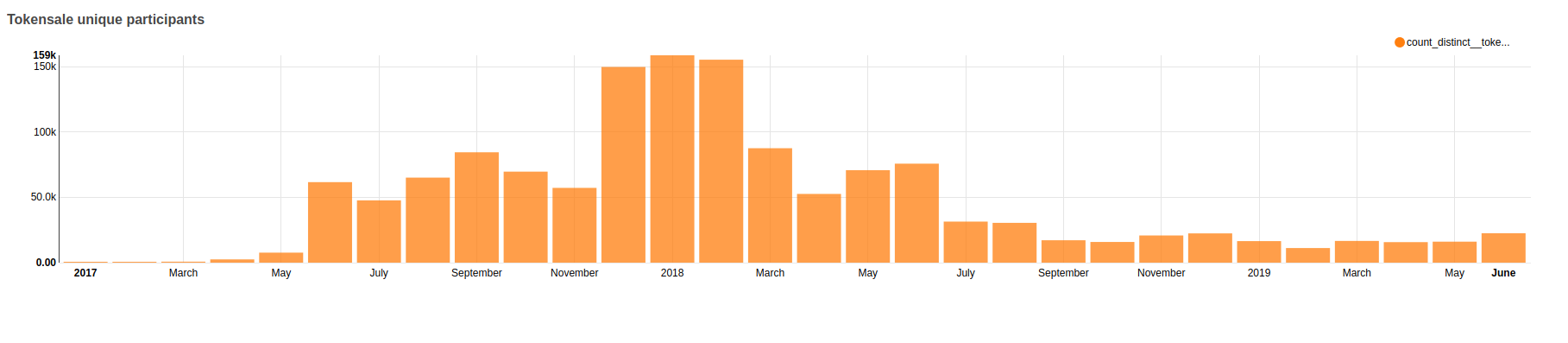

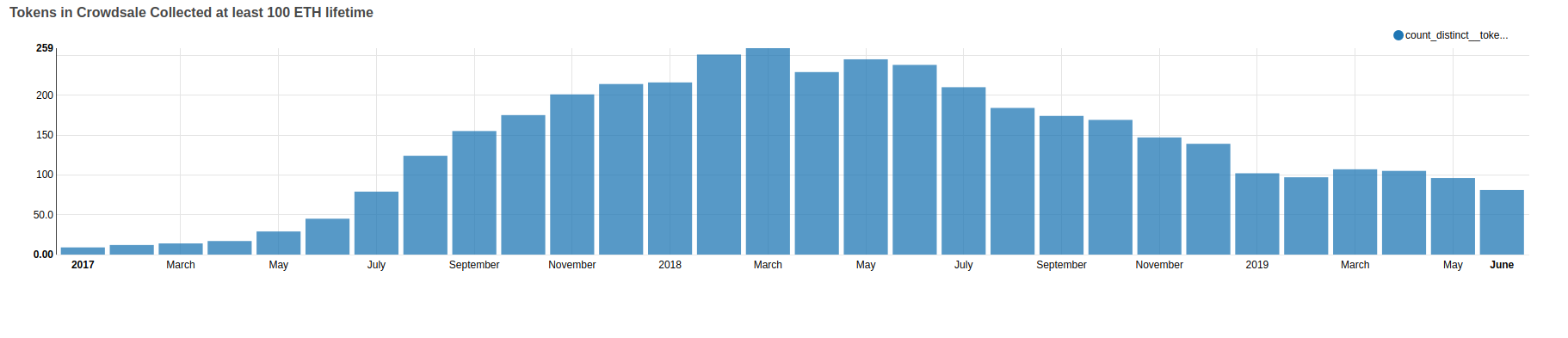

No More ICO Buzz

The first half of the 2018 saw a massive boom in crowd sales. Thousands of ICO’s raised Billions of dollars. There were a lot of scams too, but bear market killed “easy money” and ICOs are not able to attract investors so quickly anymore. Only 189K Ethers were invested in different crowd sales last month, compared to 1.92M Ethers invested in June 2017. (ETH price in June 2017 ~$350 and in May 2019 ~$250).

Let’s see what happens in June 2019 >>

Average Ether collected per token sale — 207 ETH

Average transaction per token sale — 116

Average Ether per transaction — 1.99 ETH

Average amount of Ether participation token in a token sale — 6.05 ETH

81 crowd sales out of 589 collected more than 100 ETH in June 2019.

22.5k buyers participated in different token sales in June 2019.

Good projects will always manage to raise funds, but now ICOs receive more scrutiny from investors and regulators, so it’s a much more difficult process. A bull market can certainly change the dynamics of this — so we’ll have to see.

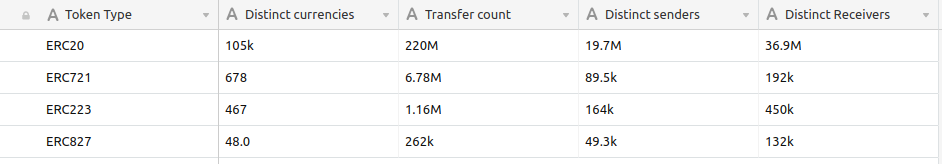

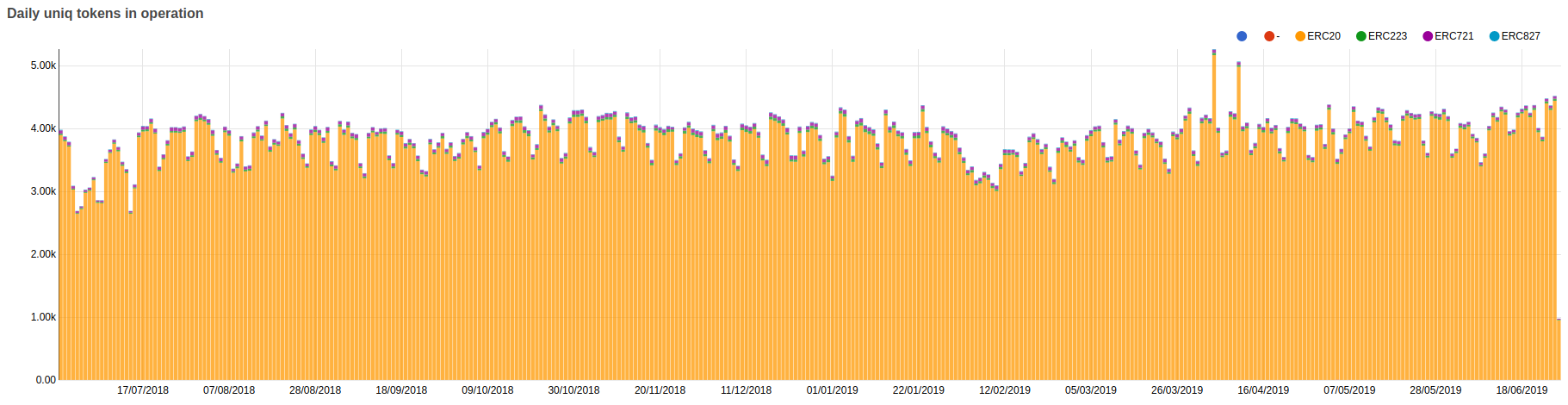

Different ERC Standards in Use

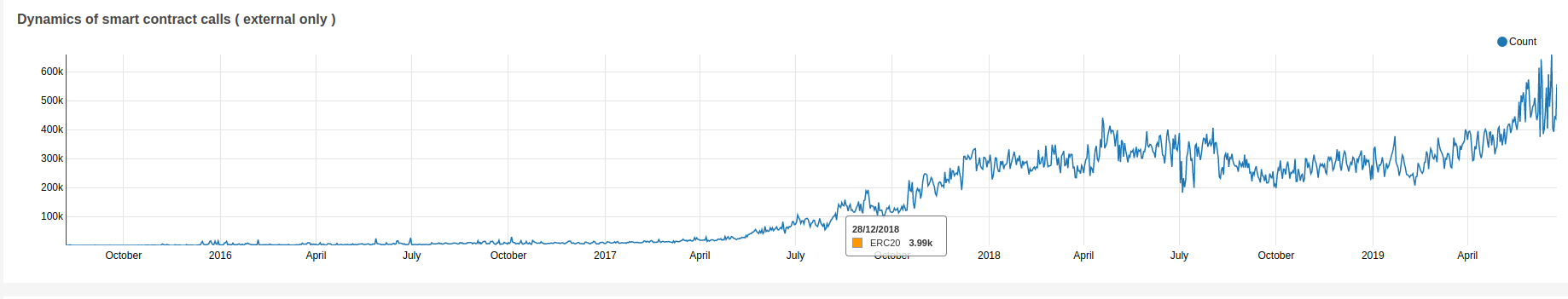

The ERC20 token standard is widely accepted. There are over 45,000 tokens on Ethereum and the majority of them are ERC20. Active token counts are increasing and we currently have 2700 unique tokens with an average of 330,000 daily transactions — which are equal to ETH’s daily average transactions.

Despite that ERC233 and ERC827 are considered “better token standards for ERC20 replacement”, they haven’t gotten significant traction, having only a small fraction of total actively used currencies.

- More than 4,000 tokens having an active daily transaction.

- CryptoKitties received around 67.5k ETH and around 1.48 Million transactions until now.

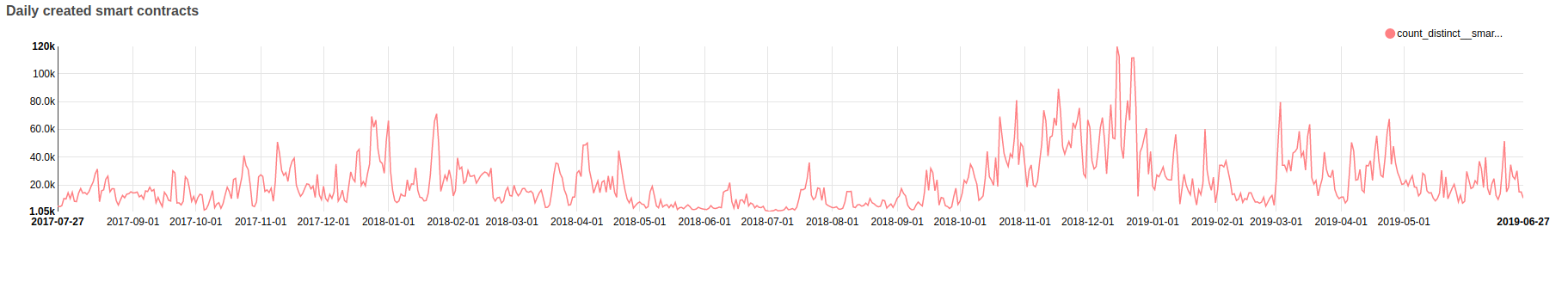

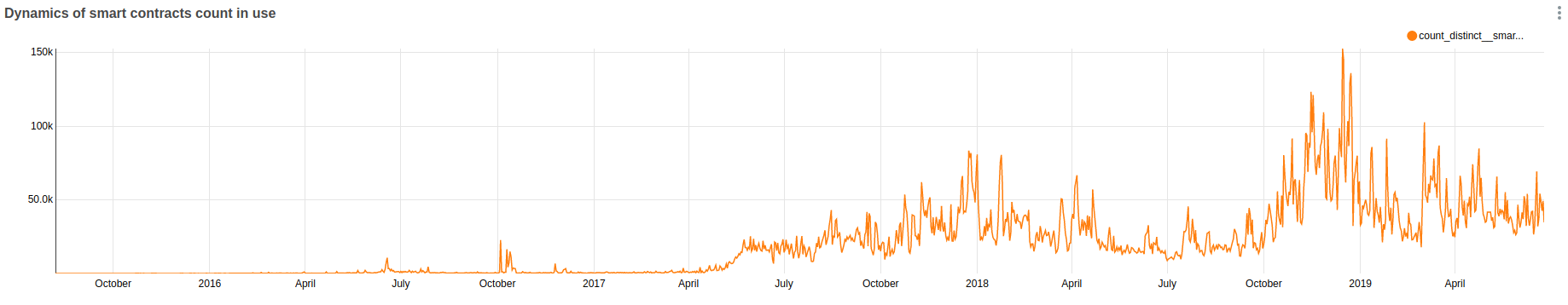

Smart Contract Creation

Ethereum is a Smart Contract platform and the growing number of Smart Contracts per month shows developer adoption. In May 2019 alone, more than 500,000 Smart Contracts were created and 99% of them are the generic type. Token sale contracts are in the second position, but they are nominal in terms of generic contracts.

Being a tech platform, developer adoption is one of the most important metrics for Ethereum. More developers = more ideas and innovations. This will be the key to Smart Contracts’ use and widespread adoption.

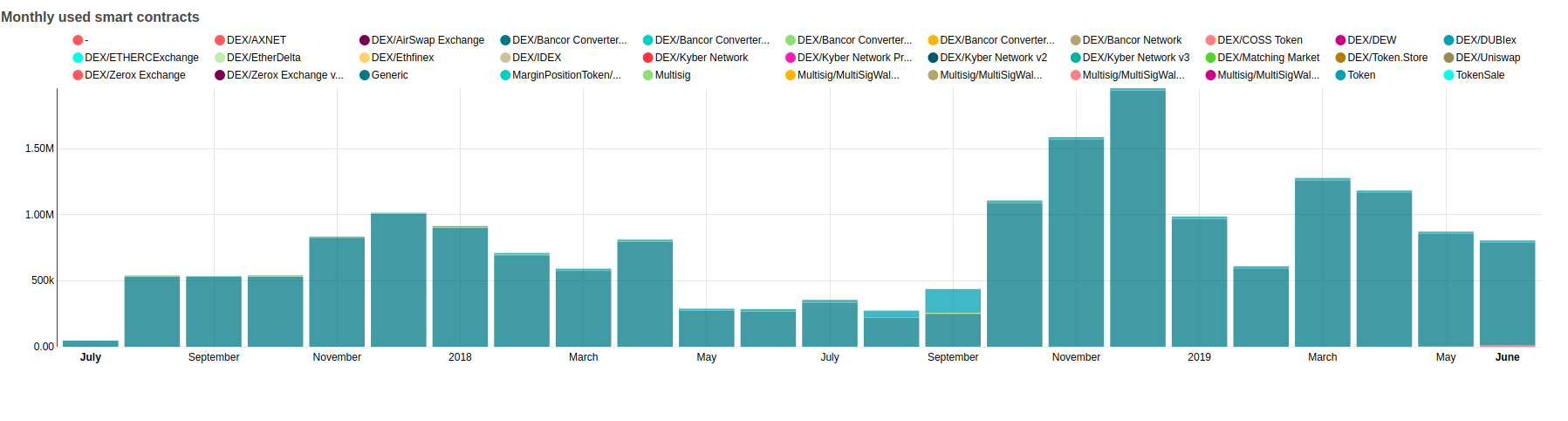

Smart Contract Usage

Smart Contract usage is steady and declined only slight from the last year. However, Smart Contract call data now shows that contracts are being used more. In my view, Smart Contract usage is the only metric we should focus on.

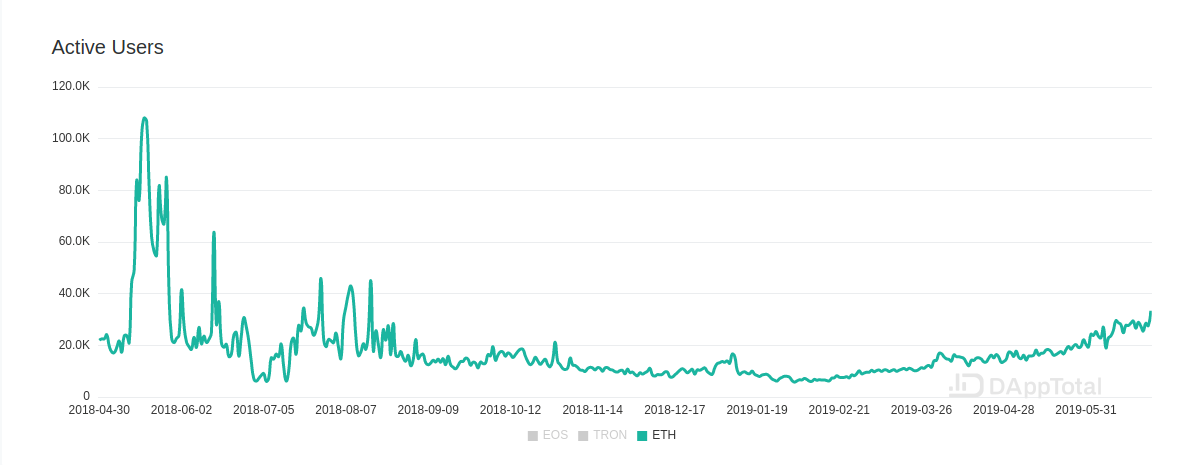

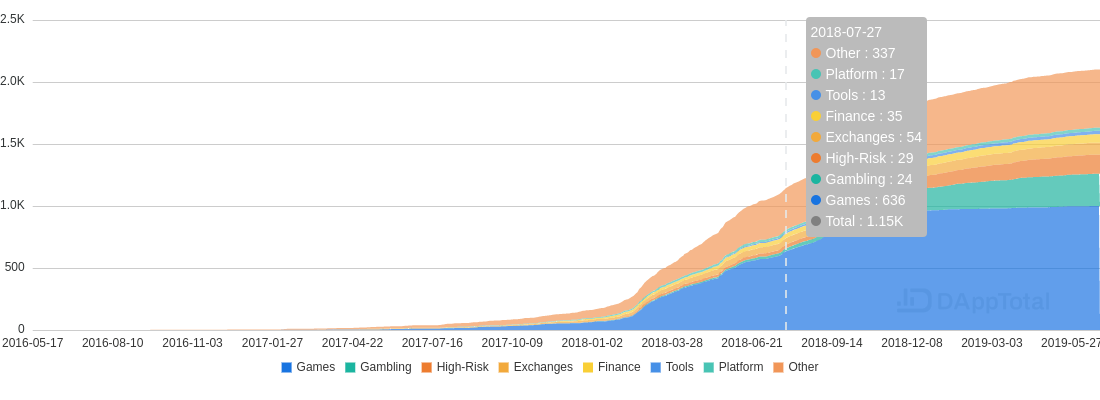

How are dApps Doing?

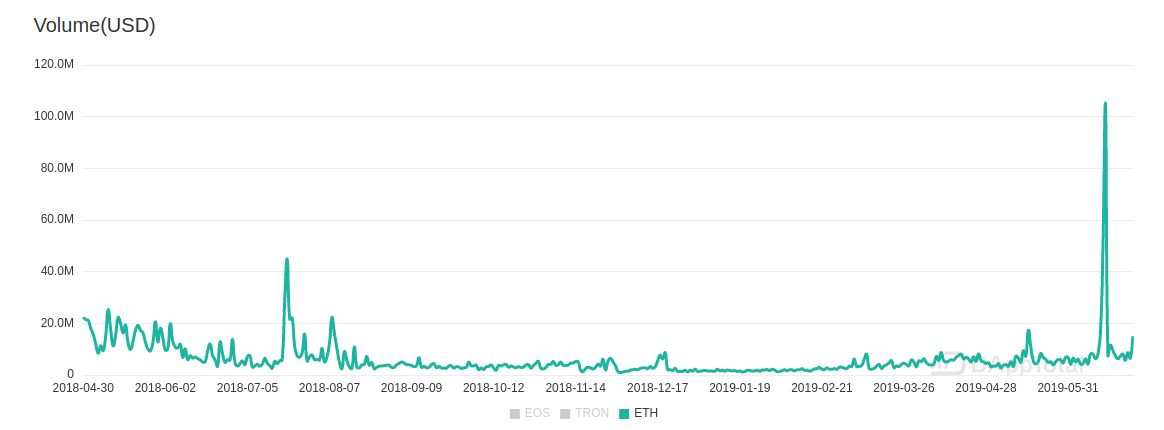

On the dApp adoption side, things somehow didn’t change much since last year. Currently, there are around 27K users/day for all the dApps built on Ethereum. That said, Ether volume on dApps is growing and is now around 22.98k ETH per month.

Most of the ETH volume is on Exchanges (trading tokens), DeFi (decentralized finance — lending, borrowing, etc…), and Games/Gambling. When we talk about the number of daily users, the Gaming category is on top.

Storage is one more interesting category which is getting the attraction recently.

#DeFi is on the Move

Decentralized Finance is growing exponentially and we will dig into DeFi stats in the next article, so make sure you will subscribe for our newsletter below!

Conclusion

One can see from the evidence ☝️ that there is growth in dApp market, but we will need more breakthroughs for adoption (i.e. mobile device adoption will be the key for #Web3 technology going mainstream).

Ethereum is an important decentralized platform, and while ICOs are interesting vessels for fundraising, they are not the future — dApps are.

Intermingled dApps will create scalable web services, which will yield better UX, hence lead to mainstream adoption. Projects focused on building this infrastructure will see great success in the future.

I believe we are at the dawn of the decentralized Web, a web where privacy, censorship-resistance, and self-sovereignty will be built-in. I hope we will continue on this path. As we saw the rise of different technologies and how they affect human life, decentralization will be the most important technology which will fundamentally change human behavior for collectively sharing and exchanging information on the Internet.

We needed a truly global economy and decentralized tech is the pathway. Users will have the utmost freedom and participation cost will be reduced to just having an internet connection.

Data Source: Bloxy, StateOfTheDapps, DappTotal

Need help with your project or have questions? Contact us via this form, on Twitter @QuickNode, or ping us on Discord!

About QuickNode

QuickNode is building infrastructure to support the future of Web3. Since 2017, we’ve worked with hundreds of developers and companies, helping scale dApps and providing high-performance access to 16+ blockchains. Subscribe to our newsletter for more content like this and stay in the loop with what’s happening in Web3! 😃