Feature Fridays: SmartWhales

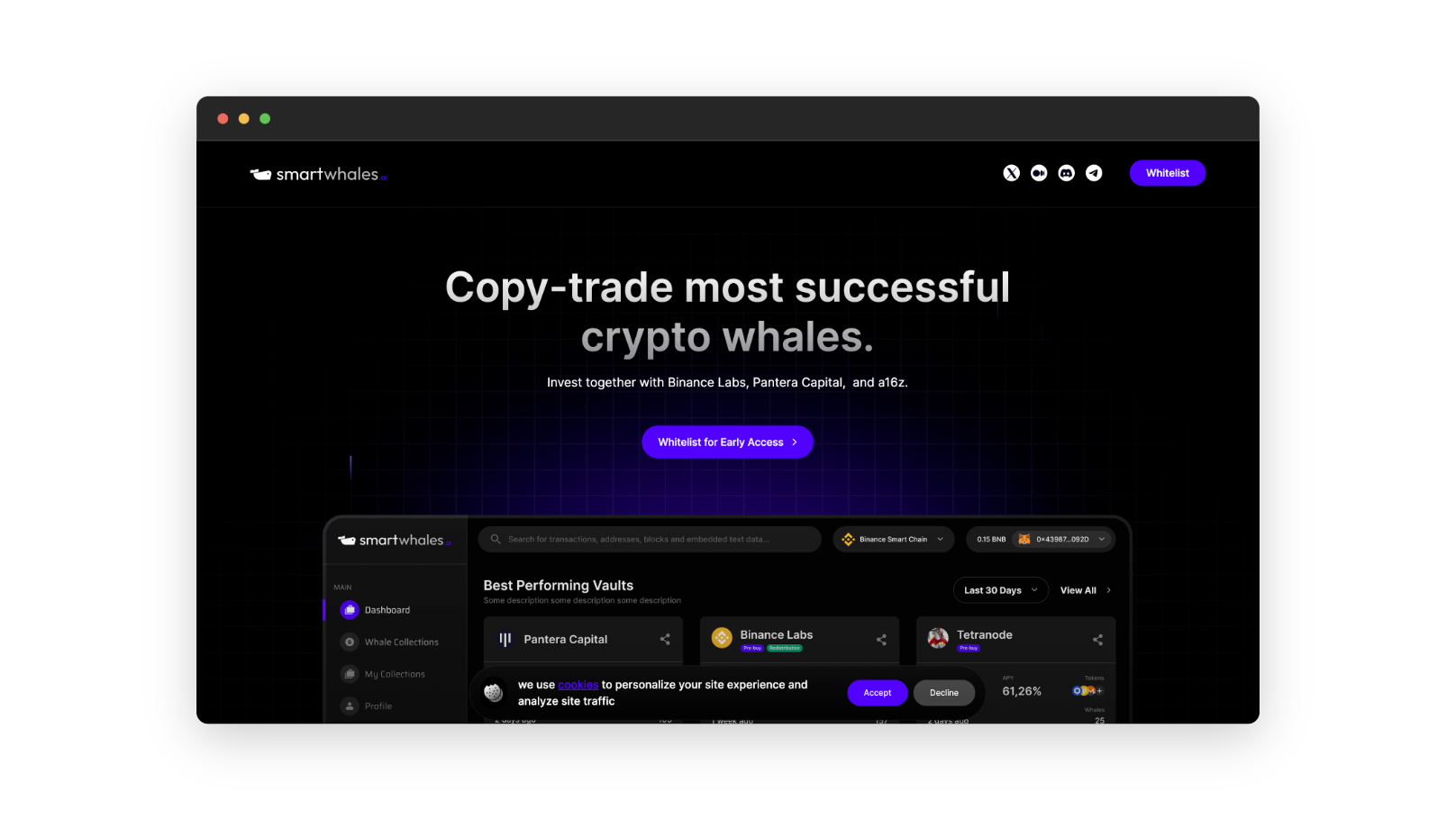

SmartWhales simplifies on-chain trading for retail investors by automating investment alongside top crypto funds, making advanced strategies more accessible.

Welcome back to Feature Fridays! Today, we're diving into the innovative world of on-chain investing and trading with Peter, the founder of SmartWhales.

With over ten years of software development experience in Crypto Valley, Zug, Peter has been instrumental in shaping SmartWhales. His deep involvement in cryptocurrencies and smart solutions for tracking on-chain money flows has set the stage for the company's unique mission.

SmartWhales is revolutionizing the way retail investors engage with on-chain trading. By offering a fully automated solution to invest alongside top crypto funds, they're making advanced investing strategies accessible to a wider audience.

Learn more about SmartWhales.

Q & A with SmartWhales 👇

Could you introduce yourself by sharing your name, prior experience, and current role within your company? Additionally, please briefly explain your company's mission and what it offers to its customers.

I am Peter, and I have been working as a software developer for over ten years in various big tech companies and early-stage startups in Crypto Valley in Zug. Since 2018, I have been investing in cryptocurrencies and developing smart solutions to track smart money flows on-chain. The mission of my current company is to simplify on-chain investing and trading and bring it closer to retail investors. SmartWhales offers a fully automated solution to follow and invest with on-chain traders and investors - imagine investing together with the most profitable Crypto Funds, such as Galaxy Digital, and Pantera Capital - what could be better?

How has your company grown and changed since its inception, and what do you have planned for its future?

Before SmartWhales, we developed various APIs to help investors track smart money flows and trade with them. However, we realized that performing those trades on-chain is extremely time-consuming and risky, especially in bear markets - low liquidity and slippage risks. Therefore, we started developing a fully automated on-chain trading system that helps to mitigate risks and solves the complexity of DEX trading.

What inspired you to develop SmartWhales, and how did you conceive of the idea?

We started developing the solution in 2022, in the deep bear market, trying to understand how to capture most of the potential of the upcoming market cycle. We started tracking smart money flows, talking with various traders and investors to understand what are their needs to develop the best product for the market demand.

We also partnered with KOLs and traders to build the best-of-the-market affiliate system to distribute the awards fairly to platform users. We understood that it is extremely complicated to trade manually by following smart money flows and traders; therefore, we saw a huge demand for automated trading and tracking systems. Especially after the collapse of FTX, we realized a huge market demand for on-chain, decentralized trading products where most traders are looking for a fully own-custody trading platform.

Can you provide insight into SmartWhales’ progress by sharing any metrics or milestones indicating its traction?

Our team has a a great combination of tech and business development; therefore, we are already equipped with a great network of traders,, bringing over 300M USD Trading Volume. During the first few months of the Early Access launch, we managed to attract over 1,000 pre-registered traders to test our MVP which is scheduled to be live in February 2024.

Can you provide insight into the target market for SmartWhales and what types of clients you work with?

We have created a product that will change the game in on-chain trading and investments, allowing us to avoid centralized entities while investing in digital assets. We are focusing on retail clients at the moment, however, we, have plans to create more institutional focus on-chain trading solutions.

How does your company utilize QuickNode, and what benefits does it bring to your business operations?

We are happy to partner with Quicknode using their Core RPC API to get alerts for the best smart money moves and get data from blockchains to perform trades.

About QuickNode

QuickNode is building infrastructure to support the future of Web3. Since 2017, we've worked with hundreds of developers and companies, helping scale dApps and providing high-performance access to 25+ blockchains. Subscribe to our newsletter for more content like this, and stay in the loop with what's happening in Web3!