Feature Fridays: Webform

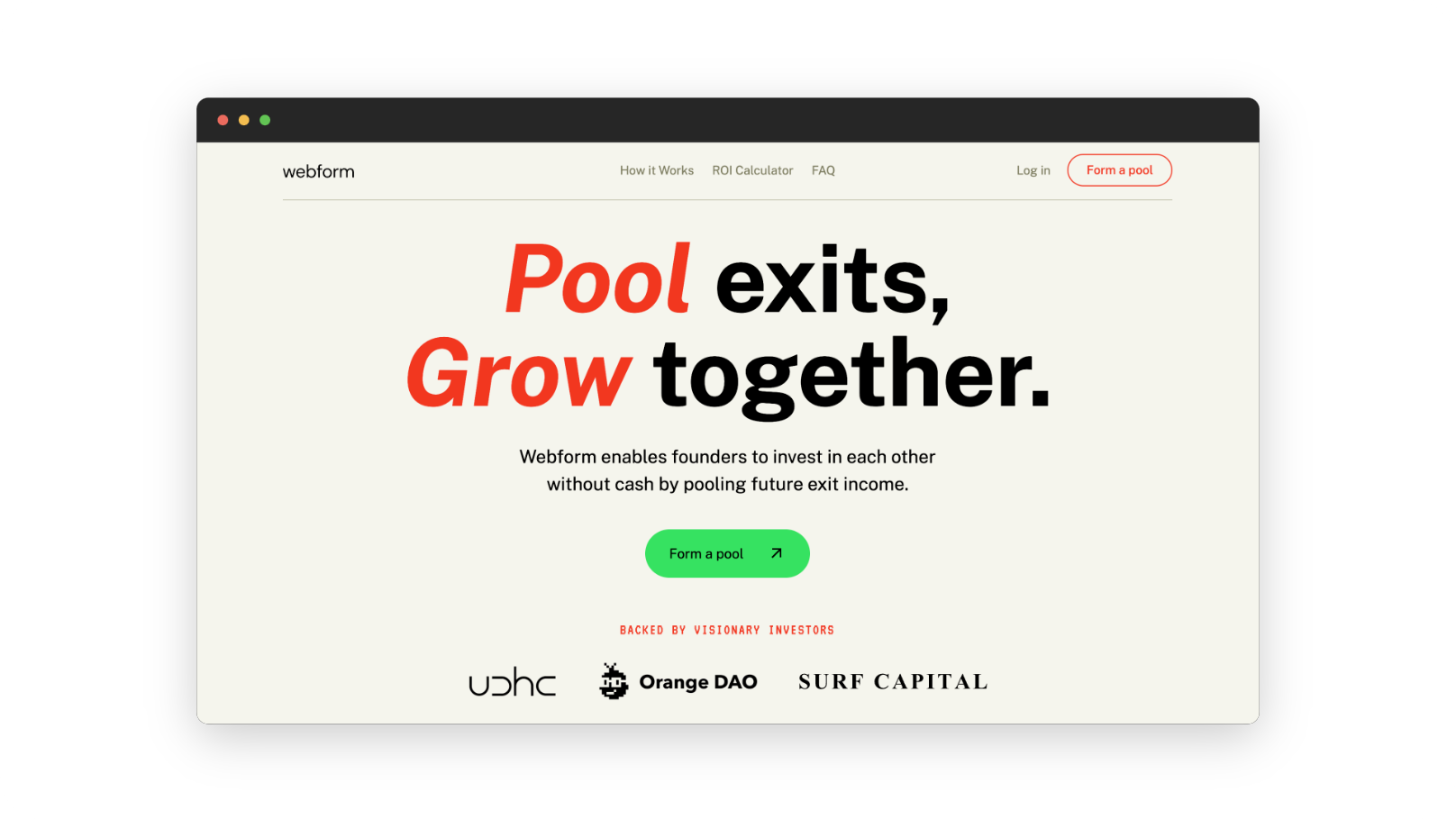

With Webform, founders can invest in each other's success by pooling future exit percentages to create innovative financial products.

Welcome back to Feature Fridays! Today, we jump into the innovative world of venture liquidity with Matei, the CEO and Co-Founder of Webform. Drawing from rich experiences at MIT, the tech industry, and the financial markets, Matei and his co-founder, Logan, are revolutionizing how founders manage and leverage their paper wealth.

Webform’s trailblazing mission? To empower founders by unlocking the potential of their illiquid startup equity. By creating a platform where founders can pool a percentage of their future exits, Webform facilitates a cashless betting system on the success of peer ventures. This approach not only fosters a vibrant community of innovators but also paves the way for modern financial products that build upon these pooled resources.

Check out Webform

Q&A with Webform👇

Could you introduce yourself by sharing your name, prior experience, and current role within your company? Additionally, please briefly explain your company's mission and what it offers to its customers.

Hi, I'm Matei, CEO of Webform, and along with my co-founder Logan, COO, we’re leveraging our experiences from MIT, Microsoft, and leading a company to an IPO to turbocharge venture innovation. At Webform, we address the most common founder problem: being paper-rich but cash-poor. Using Webform, founders bet on other founders without cash upfront by pooling together a percentage of their future exits. These pools are Maker-like vaults, enabling us to build modern financial products on top of them.

How has your company grown and changed since its inception, and what do you have planned for its future?

We’ve seen remarkable growth. We raised a $0.5M pre-seed in April 2023 from UDHC, OrangeDAO, and Surf Capital. Two months later, we launched in June. We’ve since unlocked over $15M of value for top founders backed by Y Combinator, Coinbase, and Dragonfly, who love using our product to bet on great founders around them and create community. We’ll be creating modern financial products to further unlock this illiquid value next.

What inspired you to develop Webform, and how did you conceive of the idea?

I learned firsthand that paper wealth is idle wealth building my last startup. Despite being paper-rich, I was cash-poor, which meant missing out on numerous promising opportunities around me. The situation was further exacerbated when an ongoing sale of our business coincided with COVID, leading to a last-minute asset sale in lieu of the planned equity sale. This unfortunate turn of events left me and other shareholders with little to show for our hard work. Then I found the Founder's Pledge, where approximately $10 billion in exit income is already pledged to charity, primarily for tax benefits. It made me wonder: what if future liquidity was instead redirected to back founders and underwrite modern financial products? Such a model would accelerate innovation by being a net positive for founders, their startups and their investors. The world would be a better place because of it.

Can you provide insight into Webform’s progress by sharing any metrics or milestones indicating its traction?

One of the most telling indicators is the response from founders: over 80% agree to join the pool they’re invited to. Similarly, for funds that pool with us, we've been able to increase fund performance by approximately 30%.

Can you provide insight into the target market for Webform and what types of clients you work with?

For Seed and Series A founders the opportunity to use their paper wealth to invest in other ventures is particularly valuable. At this stage of their journey, they are the most cash-constrained but hold significant unrealized value in their startups and are part of diversified venture portfolios. Webform enables these founders to leverage this potential in a meaningful way, not only for their benefit but also for the broader ecosystem around them.

How does your company utilize QuickNode, and what benefits does it bring to your business operations?

Tokenizing our pools is a significant step forward for our business model, and I can see QuickNode playing a pivotal role in facilitating this transition.

For more exciting developments and to explore creating a pool, visit webform.vc.

About QuickNode

QuickNode is building infrastructure to support the future of Web3. Since 2017, we've worked with hundreds of developers and companies, helping scale dApps and providing high-performance access to 24+ blockchains. Subscribe to our newsletter for more content like this, and stay in the loop with what's happening in Web3!