How Prediction Markets Are Maturing Into Financial Data Infrastructure

Prediction Markets and Beyond: The Global Financial Data Infrastructure Building on top of Polymarket

Prediction markets are moving billions in volume, shaping media narratives, and attracting institutional attention.

But, why is glorified betting such a massive headline generator?

With prediction markets comes opinions of the masses validated by their own money. This creates real-time data on elections, interest rates, player trades, and everything in between and beyond.

For builders, this opens up a new frontier: prediction markets as programmable infrastructure.

This blog explores why they’re booming, the opportunities ahead, the regulatory hurdles, and the infrastructure required to keep them running at scale.

The ABCs of Prediction Markets: Why They Are Booming Now

Simply put, prediction markets are the marriage of stock markets and betting pools.

Prediction markets let traders buy and sell shares tied to uncertain future events. Each share represents a probability:

- If the event happens, it pays out $1.

- If it doesn’t, it pays out $0.

The market price in between reflects the crowd’s collective expectation. For example, a share priced at $0.63 implies a 63% chance of the event occurring.

Also, prices shift as participants act on new information.

What we end up with is an aggregate of the knowledge, opinions, and incentives of all participants into a single, real-time probability estimate.

Historically, prediction markets have existed in academic and financial circles as derivatives or thought experiments.

Today, platforms like Polymarket and Kalshi have turned this into a mainstream product across politics, sports, economics, and pop culture.

- Polymarket maintains thousands of markets spanning cryptocurrency prices, geopolitical outcomes, celebrity news, and corporate earnings.

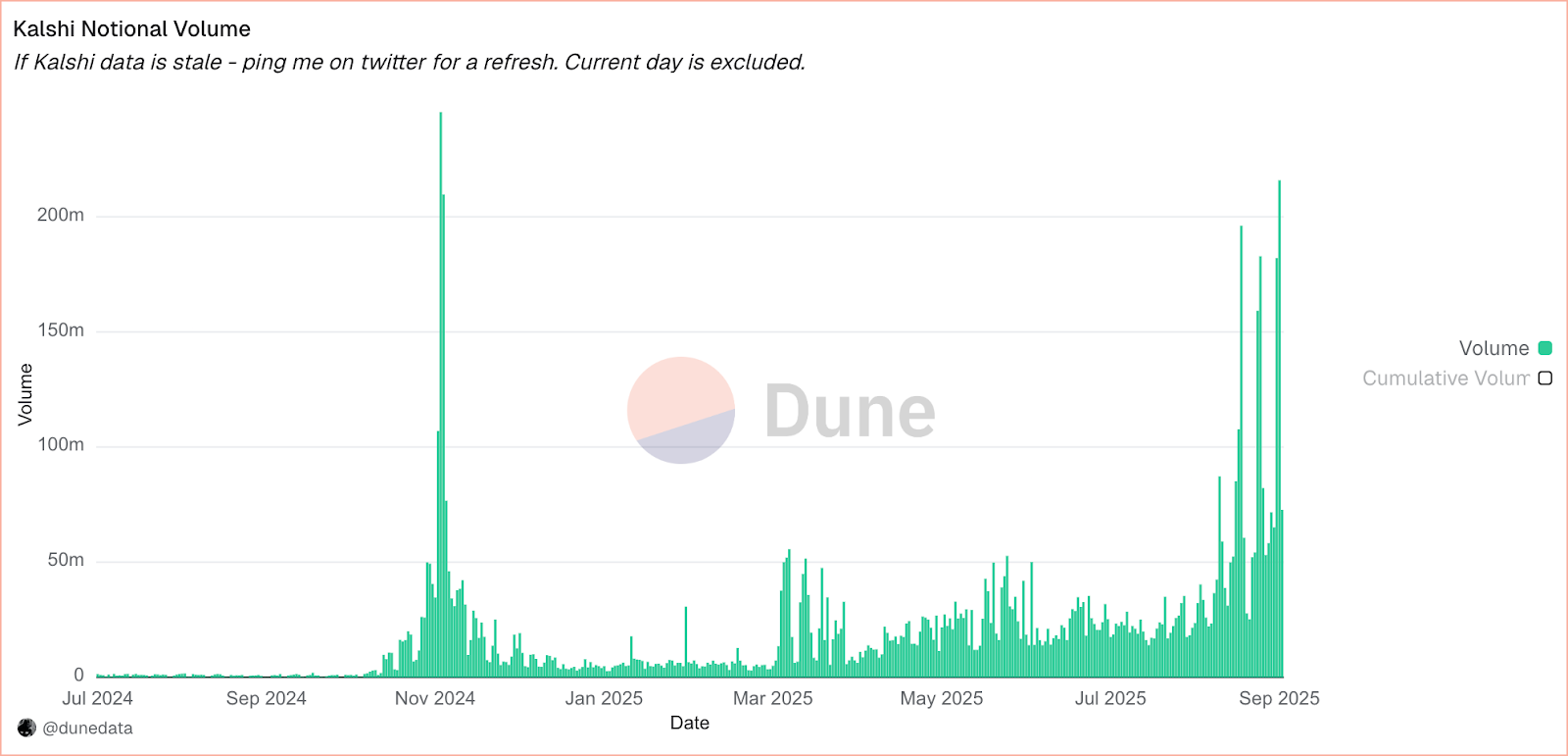

- Kalshi offers over 1500 active markets covering Fed decisions, weather events, award shows, and economic indicators.

So Why Are Prediction Markets Booming In 2024–2025?

Three converging forces explain it:

- Massive Liquidity: High-stakes events like the US presidential election have surged Polymarket volumes into the billions.

- Regulated On-Ramps: Kalshi, the first fully CFTC-approved exchange for event contracts, has created a legal pathway for US traders.

- Expanding Market Categories: What began as mostly political speculation has broadened into sports, macroeconomic indicators, and cultural events everything from interest rate decisions to TV finales.

This diversification reduces platform dependency on election cycles while creating year-round engagement.

Prediction Markets in Numbers

Here are some numbers and metrics that reflect the current state, recent growth, and the adoption of prediction market platforms:

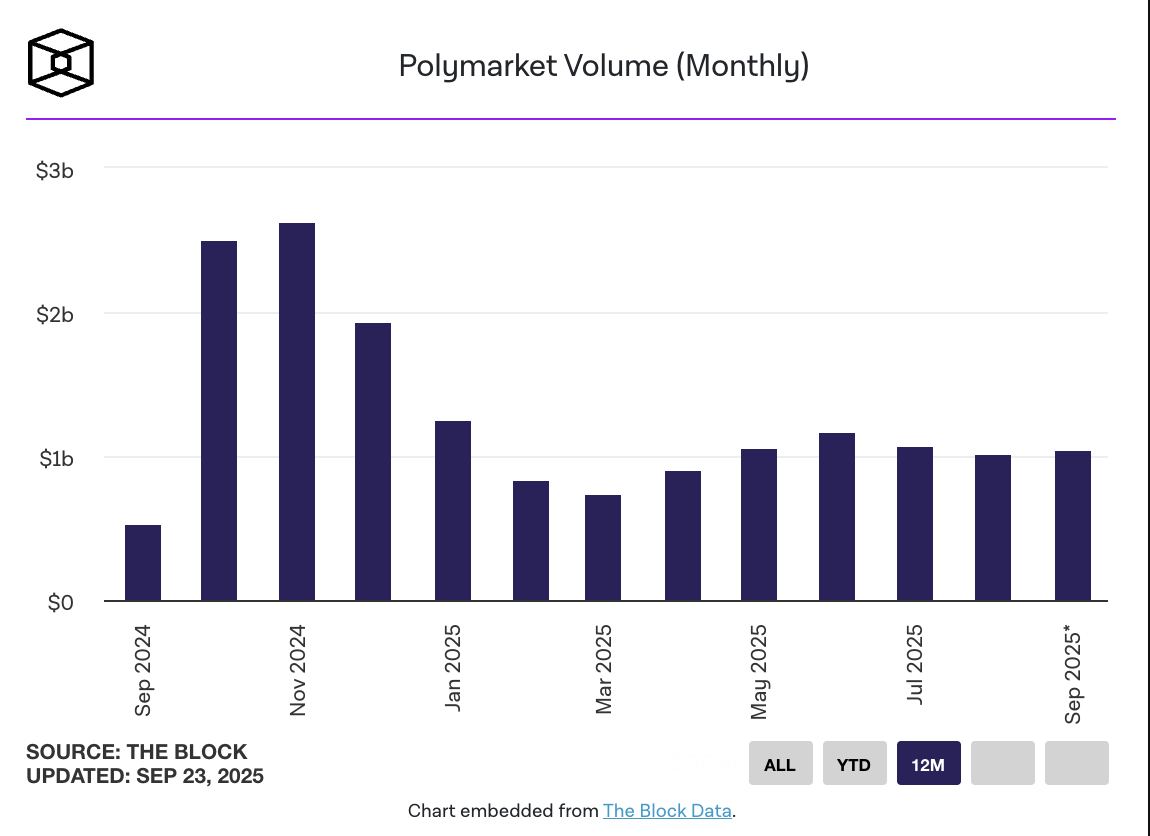

- Polymarket processed over $3.3 billion on the 2024 US presidential election alone, peaking above $2.5 billion in volume in November 2024

Source: Polymarket Volume (Monthly)

- More than 24000 markets were created on Polymarket in September 2025 alone.

- Kalshi has processed over $7.5 billion in notional trading volume in less than 15 months of going live.

Okay, but what can builders actually do with this information?

Prediction Markets as Programmable Probability Infrastructure

We all know about the surface-level reasons prediction markets are gaining traction:

1. Humans like to gamble and there's money to be made here,

2. A gamified yet democratic way to voice out opinions,

3. Reputation economics where people put money where their mouth is.

However, if we zoom out further, the real story is how these markets are entangled with politics, policy, and institutions, and are opening new ways of truth discovery, feedback loop, and even public accountability.

Let’s explore the true potential of prediction markets by understanding the most valuable resource: economically validated opinions.

Prediction Markets Generate the Most Honest and Credible Data

Unlike static forecasts or opinion polls, prediction market prices reflect participants' willingness to stake real money on their predictions. This economic validation creates information that's both current and credible.

Mathematically, prediction markets are financially backed probability assessments for any quantifiable future event.

For builders, this transforms a betting slip into something much more valuable: programmable data that can be embedded, automated, and acted upon.

Now, let’s try to answer how and what developers can build on top of this?

Practical Ways Builders Can Use Prediction Market Data

- Dashboards and Widgetswarning: Embed live market odds into apps, websites, or research platforms.

For example, an election odds widget alongside polling data, or a ‘Fed decision probability’ chart inside a fintech dashboard.

Bloomberg Terminal embedding Polymarket and Kalshi prediction markets

- Odds-Aware Alerts and Triggers: Set up automated notifications when probabilities swing sharply.

For trading apps, this works like a volatility alert and for media, it’s a headline generator.

- Treasury and Risk Hedges: DAOs and protocols with exposure to macro, regulatory, or geopolitical risks can hedge with event contracts.

For instance, a crypto treasury could reduce downside risk by taking positions on inflation or interest-rate markets.

- Community Sentiment for Governance: Markets double as a coordination tool.

By pricing “Will Proposal X pass?” or “Will the network upgrade ship by Q3?”, communities get a monetized signal of belief.

- Insurance and Coverage Triggers: Insurance companies incorporate prediction market data into dynamic pricing models.

A DeFi insurance protocol could reference markets like “Will a Category 3+ hurricane hit Florida this year?” to dynamically adjust premiums or release capital.

- Reputation and Influence Metrics

Analysts, influencers, or DAOs can be ranked by how their bets align with market moves over time, creating a quantifiable reputation layer.

These examples move beyond abstract ‘data streams’ into real hooks for products, treasuries, communities, and umpteen other ways builders can treat markets as APIs for probability.

But, before developers and builders start building, there’s a hurdle that needs to be navigated — regulations.

The Regulatory Environment For Prediction Markets

If the last two years have proven anything, it’s that prediction markets cannot escape regulation. In the United States, the Commodity Futures Trading Commission (CFTC) is the central referee, and it has already made clear that most event contracts look like binary options or commodity futures in its eyes.

In 2025 alone, the regulatory environment for prediction markets has undergone dramatic reversals.

This creates both opportunities and compliance risks that builders must understand before entering the space.

Key Moves from the CFTC

- Polymarket Enforcement (2022): The CFTC fined Polymarket $1.4 million and forced it to block US users for offering unregistered event contracts. The platform has since announced plans to re-enter the US through a regulated exchange license.

- Kalshi’s Legal Battles (2023–2024): Kalshi fought the CFTC in court to list political markets, winning a pivotal decision that forced regulators to back down. It can now legally list election-related contracts under CFTC oversight.

Outside the major two, States, meanwhile, are beginning to challenge sports-related contracts as unlicensed gambling.

Eight states now actively challenge prediction market operations: Massachusetts, Nevada, New Jersey, Maryland, Ohio, Illinois, Montana, and Arizona.

What This Means for Builders

Prediction markets live at the intersection of futures law, gambling statutes, and public policy debates. That makes them inherently risky territory for developers and can destroy unprepared startups.

Some of the main warning signs:

- Commodity vs Gambling Classification

A market that looks like ‘risk management’ to builders may look like ‘illegal gaming’ to regulators.

Contracts tied to politics or sports are especially sensitive.

- Retroactive Enforcement

As Polymarket learned, volume is not protection. Regulators often move after a platform has traction, issuing fines or shutdown orders retroactively.

- State-Level Traps

Even if the CFTC allows something at the federal level, individual states may ban it (ex: Massachusetts suing Kalshi over sports contracts).

- Forbidden Categories

CFTC Rule 40.11 explicitly bans markets on war, terrorism, assassination, and ‘gaming.’ Any attempt to offer such markets is not just risky — it’s illegal.

- SEC Overlap

Markets that track stock prices or financial instruments can trip securities law, pulling the SEC into the mix.

That’s an entirely separate regulatory hornet’s nest.

For builders, the signal is clear: regulation is not optional. Builders can’t just spin up ‘bets on everything’ and hope to stay under the radar.

Given these regulatory complexities and enforcement risks, builders need concrete implementation strategies that prioritize compliance from day one rather than retrofitting legal protections after launch.

How to Build Prediction Markets Responsibly

Developers exploring prediction markets, here are practical steps to keep innovation alive while minimizing regulatory and reputational risk:

Jurisdiction Checks

Platforms should identify where they can legally operate. Without US licensing, geo-fencing and regional restrictions are essential.

Remember: Decentralization alone does not provide immunity from enforcement.

Clear Disclaimers

Prominent warnings should state that outcomes are uncertain, losses are possible, and markets are informational or hedging tools rather than investment advice. Transparency builds trust and mitigates liability.

Age and Geo Gating

Access should be limited to adults (18+ and, in some categories, 21+). Blocking regions where event contracts are explicitly illegal reduces legal and reputational risks.

Market Filters

Prohibited categories such as terrorism, assassination, or unlawful acts must be excluded.

Note: Sports and election markets require special caution unless operated through regulated venues.

Responsible Design Features

Options like self-exclusion, betting limits, and community moderation of market creation add necessary safeguards. These features increasingly align with regulator expectations.

Partnership Models

Instead of operating full exchanges independently, projects can integrate with regulated venues such as Kalshi or the forthcoming Polymarket US Prediction markets can function as APIs for probability data rather than standalone platforms.

By building compliance-first architecture and maintaining proactive regulatory relationships, responsible builders can navigate the complex legal landscape.

Sure, this approach requires higher initial investment and longer development timelines, but it creates durable competitive advantages without any existential regulatory crises that can wipe the platform out in one policy statement.

Even with sound market design and regulatory awareness, prediction platforms rise or fall on infrastructure. High volumes, thousands of concurrent markets, and sudden traffic spikes around major events demand a technical backbone that can deliver real-time data, reliable indexing, and resilient performance at scale.

What kind of infrastructure is required to run these markets at scale?

QuickNode Keeps Prediction Markets Running at Scale

Prediction markets are, at their core, data engines.

Every tick, trade, and resolved outcome must be updated, indexed, and delivered to users instantly. The challenge intensifies during high-profile moments like elections or central bank decisions, when transaction volumes and queries surge by orders of magnitude.

This requires infrastructure that provides:

- Streaming market data for live dashboards, alerts, and trading UIs.

- Efficient indexing to handle thousands of active event contracts simultaneously.

- Reliability under spikes so platforms remain responsive when billions in volume hit in a single day.

QuickNode provides the kind of infrastructure that prediction markets depend on when scale and reliability are non-negotiable.

- Streaming APIs deliver live event data with low latency, powering dashboards, odds feeds, and automated strategies.

- Indexing services allow developers to query and surface outcomes across thousands of markets seamlessly.

- Autoscaling RPC and caching ensure uptime during sudden surges, such as election night or breaking geopolitical news.

- Multi-chain support opens the door for prediction markets to expand beyond a single network and tap into broader ecosystems.

In short, QuickNode enables builders to focus on market design and user experience while ensuring the pipes stay fast, reliable, and future-proof.

What’s Next: Prediction Markets as a New Pillar of Digital Finance

Prediction markets have graduated from academic experiments to billion-dollar ecosystems. Platforms like Polymarket and Kalshi have shown that markets can capture the pulse of politics, economics, and culture in real time, and that these signals can inform dashboards, hedge treasuries, and guide governance.

But their long-term significance lies in more than trading volume.

By turning collective expectations into programmable, financialized forecasts, prediction markets create a new class of infrastructure: truth signals priced by incentives.

- For builders, that means access to data streams that are dynamic, composable, and monetized.

- For institutions, it means a chance to integrate real-time probabilities into decision-making.

The future of prediction markets will be shaped by how responsibly they are built and how resiliently they are powered. With the right compliance, infrastructure, and imagination, they can become not just platforms for speculation but a pillar of digital finance and collective intelligence.

About QuickNode

QuickNode is a leading blockchain infrastructure and solutions provider. Since 2017, we’ve helped thousands of developers and companies scale their onchain applications with lightning-fast, reliable access to over 70 blockchains. Stay ahead in the world of Web3 — subscribe to our newsletter for insights, updates, and the latest innovations shaping the future!