Solana Spotlight August 2025: Speed, Stocks, and S & M

We examine Solana trends including stocks, stablecoins, and consumer applications that aim to compete with traditional finance.

Thanks to Nick Ducoff at Solana Foundation and Anna Yuan at Perena for reviewing earlier versions of this article.

The paradox of mainstream adoption is that the more successful crypto becomes, the more invisible it gets.

The Solana ecosystem in 2025 demonstrates this principle. While media attention focuses on price movements, a different pattern has quietly emerged: applications that compete with traditional finance rather than other blockchain software.

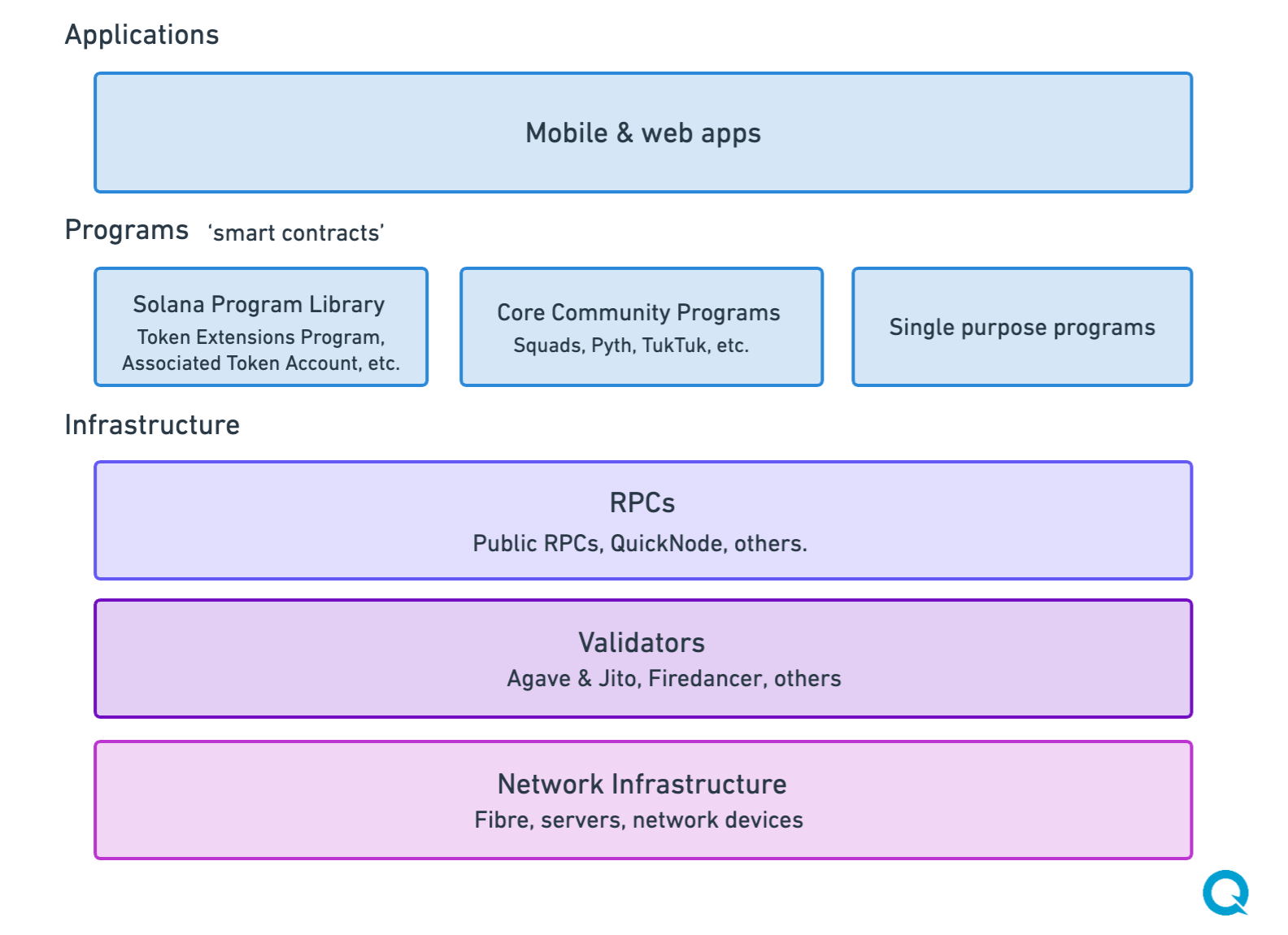

This report examines how technical capabilities at each layer of the stack enable business outcomes above it:

We'll start at the bottom and work our way up.

The boring revolution: fast and reliable validator infrastructure

Solana mainnet is a globally distributed computer that processes transactions and stores the resulting account state.

Perfect uptime and growing insurance against systemic risk

Mainnet has maintained 100% uptime for the last year, surpassing standard service level requirements from traditional finance, a key requirement for institutional adoption.

But resilience is more than just uptime. Historically, all Solana nodes used the Solana Labs validator known as Agave, which presented a systemic risk to the network since a bug in Agave could bring down the entire network. Jump Crypto’s Firedancer, a new implementation of the Solana validator protocol, is now running 9% of Solana mainnet and growing quickly, with some caveats (see ‘Looking Forward’ below).

Validators remain dispersed geographically and in different data centers, ensuring safety from interference by both state actors and private network providers. Note that there has been a reduction in the number of validators, and Solana’s Nakamoto coefficient - the minimum number of validators that need to collude to affect the network - is reduced from last year but still leading the industry. Both of these have similar causes: stake consolidation among larger validators and higher requirements for the Solna Foundation validator incentive program. As a result, the remaining validators are in better health and voting on transactions faster.

Looking forward - instant confirmations, less risk

For Agave: Solana’s most popular validator client now has a dedicated five-person performance team that is making significant inroads into finding and removing performance bottlenecks.

For those running Jito’s Agave fork, the Block Assembly Market provides a verifiable ordering and an end to sandwich attacks.

For Firedancer: the older parts of the current Firedancer version that came from Agave will be removed in favour of Firedancer’s replacements, creating an entirely separate piece of software not affected by Agave-specific issues.

For all validators: network changes to ensure all priority fees go to validators continue to incentivize participation. The new Alpenglow consensus algorithm promises finality around the speed of the blink of an eye - 150ms - and better handling of malicious leaders, provided the network handles this critical transition correctly.

Meanwhile, beneath the validators, more of Solana’s validators are moving from general-purpose public fibre to a combination of dedicated private bandwidth and hardware transaction filtering devices provided through DoubleZero. DoubleZero's fibre network, launching next month, provides deterministic performance while giving bandwidth providers a portion of the block rewards, and their hardware devices remove badly formed transactions to increase the block throughput of validators.

Why This Matters: Infrastructure Enables Applications

This infrastructure work doesn't generate headlines, but it enables everything that does. Every enterprise evaluating blockchain infrastructure asks the same questions: Can we depend on it? Will it scale? Can we explain the risks to our stakeholders? Solana's 2025 infrastructure story answers "yes" to all three.

But a validator network alone doesn't create applications. The next layer up - the programs used by other onchain apps - is where Solana's technical foundation translates into business opportunity.

Token Extensions as Product Enabler

The most successful blockchain applications of 2025 share a secret: they don't look like blockchain applications. They resemble traditional financial products, offering better interest rates, faster transaction times, perpetual trading hours, and significantly reduced fees. This transformation is only possible because of sophisticated program-level capabilities that handle compliance, user experience, and regulatory requirements invisibly.

Token Extensions Program

Token Extensions, a set of features enabled by the creatively named Solana Token Extensions program, makes a huge part of this possible. Token Extensions provide:

- Compliance controls for regulatory requirements (Permanent Delegate, Freeze Authority, Default Account state, Transfer Hooks)

- Major event handling for stock splits and corporate actions (Scaled UI Amount, Pausable)

- Private transactions using Confidential Transfers (but see notes below)

- Branding and tickers via Token Metadata

Token Extensions enable two of 2025's biggest Solana success stories:

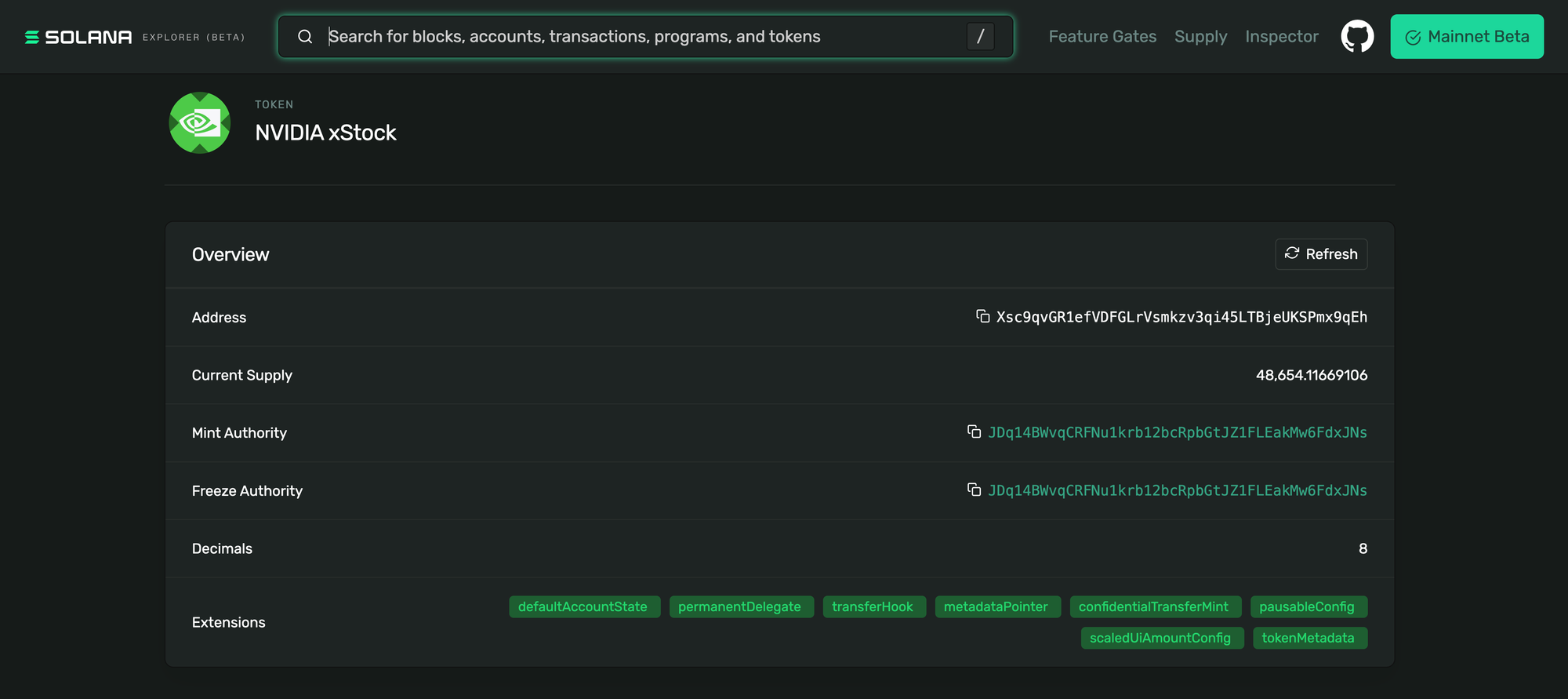

xStocks are Solana’s most popular tokenized equities system. xStocks are simultaneously:

- Equities that meet security regulations

- Tradable 24x7, freely transferable, don't have commissions, and can be used in major Solana wallets (Phantom and SolFlare) and DeFi platforms (Jupiter, Raydium, Kamino, Loopscale).

In about a month, xStocks suddenly appeared in every Solana wallet, explorer, borrow/lend platform, and strategy, and Solana has very aggressively taken the lead in onchain equities:

By July 7, 2025, there were over 45,700 holders of xStocks, with a total market cap of $51.7 million, with the S & P 500 and Telsa being the most popular (source: Mesari).

These users can trade their holdings 24/7 with instant settlement, obvious benefits over traditional finance.

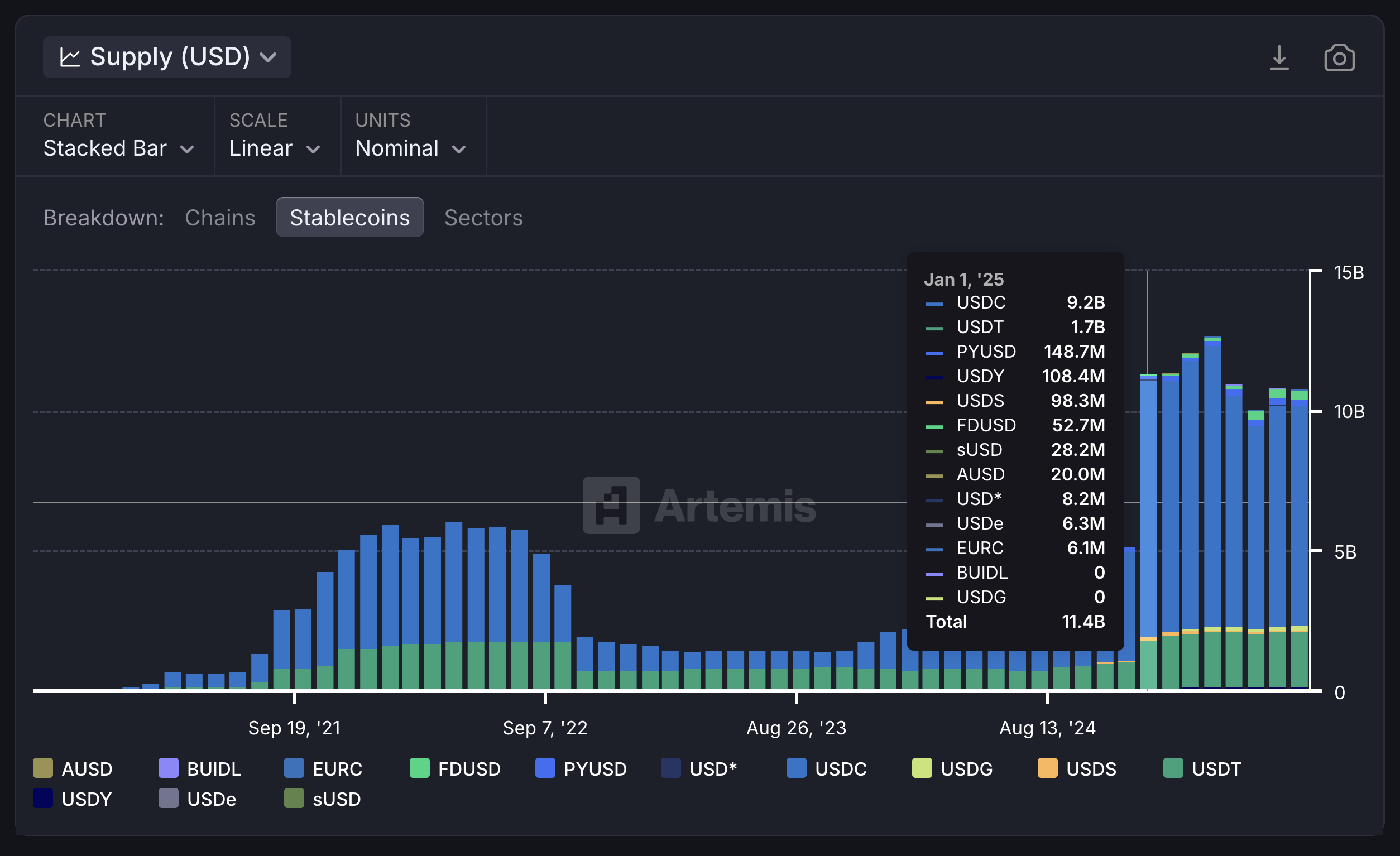

Launched a year ago, PayPal's PYUSD stablecoin has been integrated into the PayPal app, providing 400+ million users with Solana addresses. This integration eliminates the need for ‘crypto off ramps’, allowing any Solana user to swap crypto assets into PYUSD and receive the exact value in their traditional bank account.

$1000 in, $1000 out. Transferring assets to a bank account via the PayPal mobile app. Once swapped into PYUSD, the full value of digital assets is received in the recipient account.

The PayPal PYUSD integration represents one of the tightest integrations between crypto and traditional banking to date. The results are solid: PYUSD is now one of the most popular stablecoin on Solana behind long-established USDT and USDC:

Token Extensions' impact extends beyond individual applications to ecosystem-wide adoption. Because Solana wallets (Phantom, SolFlare), DeFi platforms (Jupiter, Raydium, Kamino, Loopscale), and every Solana explorer support Token Extensions natively, new financial products can launch with full ecosystem compatibility from day one. xStocks isn’t unique in that regard:

A payments app built on @Solana can ship entirely new experiences by simply swapping out the USDC token address for @xStocksFi or @orogoldapp or @DeFiCarrot, or any other future onchain asset. In (traditional finance) shipping stocks or precious metals or yield products like this would require years of engineering effort, new headcount, and new enterprise contracts.

PYUSD’s success is the pattern that defines successful crypto applications in 2025: platform capabilities that handle complexity invisibly, enabling a new class of applications that seamlessly interact with traditional finance. More on this in a moment…

Setting the Stage: Solana's Application Boom

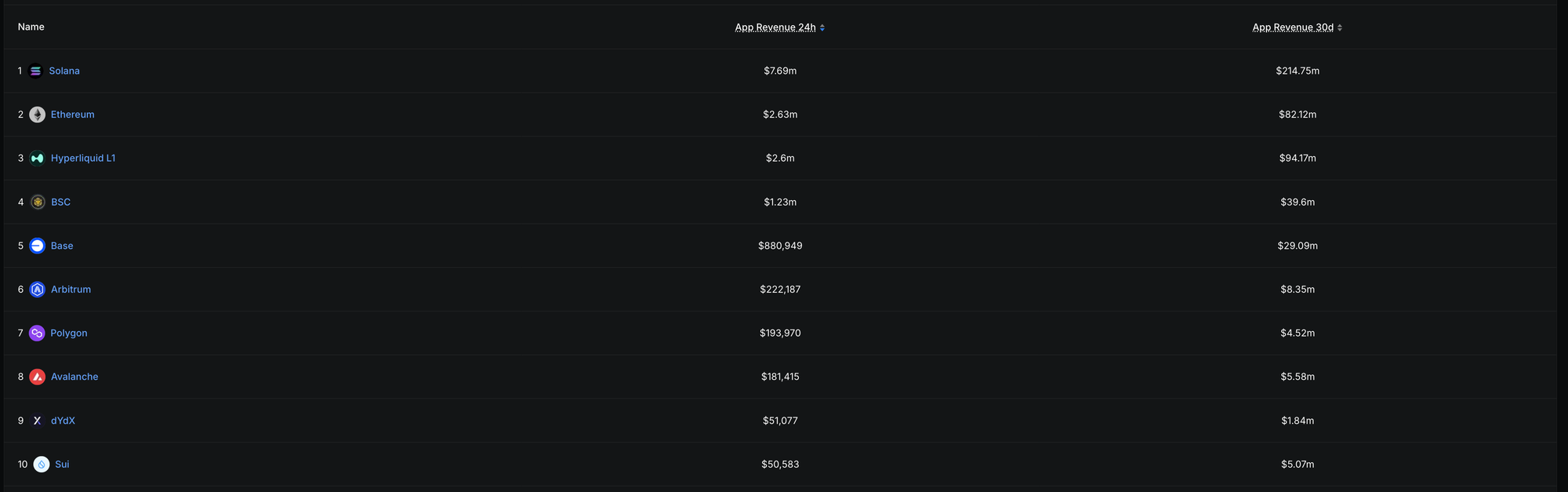

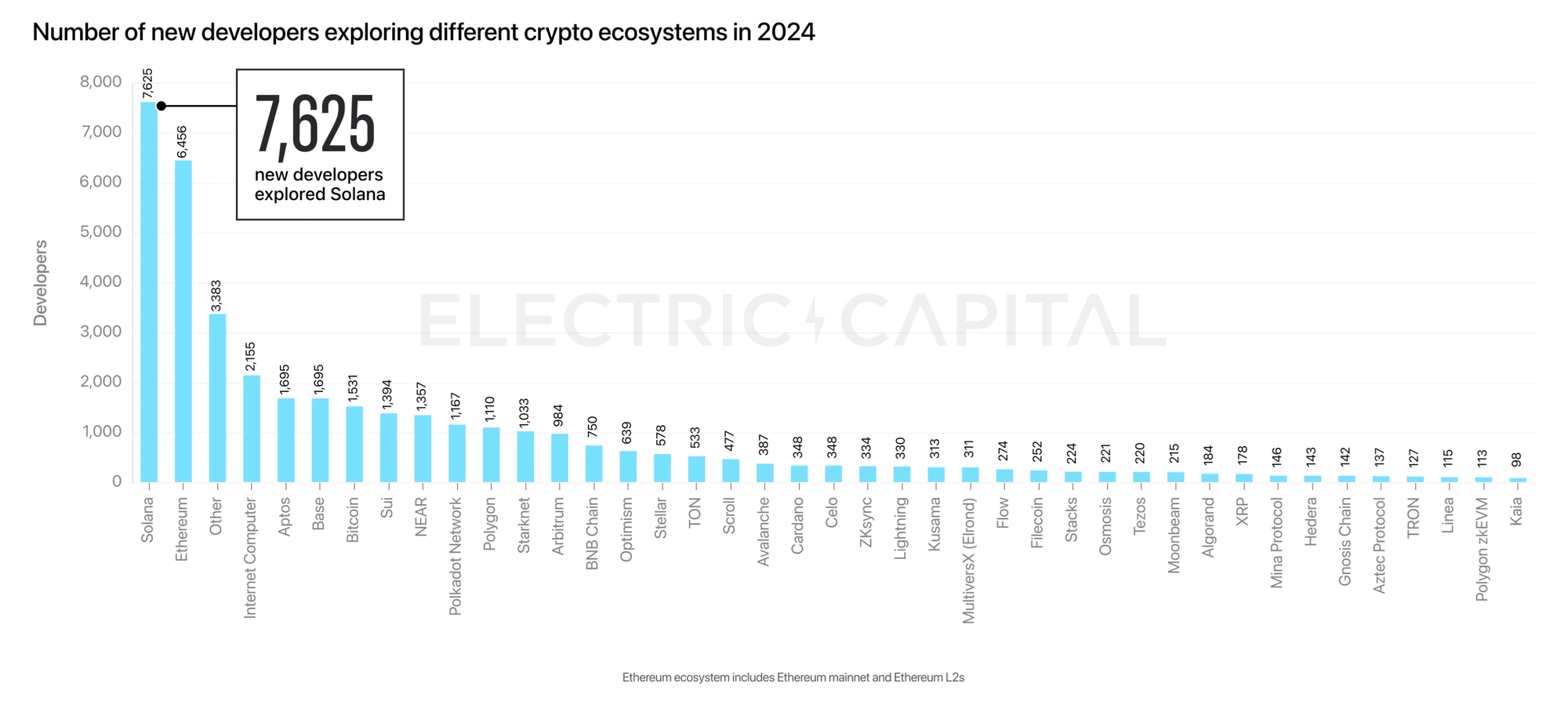

Before diving into specific applications, the broader numbers tell the story. Solana applications are generating more revenue - fees from trading, lending, and staking - than applications on other blockchains, and Solana was the #1 ecosystem for new developers in 2024.

Similarly, Solana was the #1 ecosystem for new developers in 2024:

Revenue generation indicates real utility, not speculative activity. Developer adoption suggests sustainable ecosystem expansion. But the real story lies in what these developers are building.

S&M: Stablecoins and Mobile as the Path to Mainstream

There's an emerging class of crypto applications that don't look like crypto applications at all. They're applications that succeed by making users forget they're using crypto at all, just like moving digital assets into your bank account in the PayPal app. We call these Stablecoins and Mobile - or S&M for short - but these applications share characteristics that go far beyond their name:

1. Explainable without referring to "crypto": Value propositions that make sense to anyone

2. Traditional sign-in: No wallet app required to get started

3. Stablecoin-focused: Focus on dollar-denominated assets over network or project tokens. No balances of native tokens needed for transaction fees, no other crypto ‘sharp edges’.

4. Mobile-first: distributed where people get apps: in mobile app stores..

These applications succeed by competing with traditional finance rather than other crypto protocols. They win by being better versions of familiar products, not by being novel crypto experiments.

Lulo: the savings account that beats banks

@uselulo is a savings account that has better returns than traditional savings accounts. Built around stablecoins to avoid the ebb and flow of traditional crypto assets, Lulo moves deposits to a select group of audited borrow/lend platforms to achieve maximum yield, adding a clean user interface, an iOS app, and insurance (via the Lulo Protect product) to win over traditional users.

Localpay: pay in dollars at retail in Asia

@localpayasia enables visitors to Vietnam and soon other South East Asian countries to make payments anywhere in the country. It’s non-custodial, requires ny crypto knowledge and uses USDT behind the scenes.

Pyra: spend without selling

@getpyra allows users to spend against assets without selling them. This is a modern version of a financial play typically used by high-net-worth individuals: get loans for day to day spending, rather than sell assets, and use the increase in value of the assets to pay the loans. As well as being more tax-efficient, it allows one to keep their wealth. Pyra uses regular payment cards so it works everywhere, and users never borrow more than your spending requires. Note: the author is an investor in Pyra.

AmpPay: daily spending with better yield than your bank

Focused more on day-to-day use than Lulo, @getAmpPay combines the convenience of a regular credit card with 8.25% savings rate.

Moonwalk: social fitness accountability

@moonwalkfitness is a social fitness app where you and your friends commit to a fitness streak with a deposit: the players who break their streak reward the players who keep at it.

Decaf: instant global remittance

@decaf_so is a global remittance app that works with bank transfers, cash, or crypto, avoiding the high transfer rates of incumbents like Western Union and allowing people in countries with unstable local currencies to easily hold USD.

Lulo, Amp Pay, Pyra, Decaf, Moonwalk, and LocalPay in the iOS app store

These applications succeed because they solve real problems that traditional apps handle poorly: low savings yields, illiquid wealth, expensive remittances, meaningless points, and currency conversion. They utilize crypto's capabilities - programmable money, global settlement, and disintermediation - to deliver enhanced versions of familiar financial products.

When crypto stops looking like crypto, it starts winning against traditional finance. The most successful applications of 2025 are those that make blockchain technology invisible while making its benefits obvious.

The Last Mile: Solving the Final Barriers to Universal Adoption

But even with this progress, barriers remain. Two final innovations needed for universal adoption are already in development. They address the last friction points that keep Solana from reaching everyone: onboarding friction and privacy concerns.

Removing Onboarding Friction: Reusable Credentials

As crypto moves closer to the mainstream, the need for compliance has arisen, including KYC status, geographic eligibility, creditworthiness, and accredited investor status. This creates onboarding friction: each new app requires yet another KYC experience, which makes crypto apps feel as cumbersome as their traditional finance counterparts.

Many groups have attempted to resolve this throughout Solana's evolution, with countless new systems for proving user credentials. Each system has been limited by single-entity control, creating dependency on a single supplier, and thus has been ignored by apps in favour of implementing their own verification processes. The result for users mirrors the early internet's fragmented login systems before social logins became standard. Just as users don't want to create new accounts for every website, they don't want to repeat identity verification for every financial application.

Solana Attestation Service promises a future where, once you prove something about your Solana account, you never have to prove it again. Like xStocks' success through using Token Extensions rather than proprietary platforms, the Solana Attestation Service is another standard built by the Solana Foundation.

The service is live on mainnet with Solana Foundation support and adoption by nearly every major KYC and identity partner in the ecosystem:

This infrastructure enables the seamless onboarding that mainstream applications require. Instead of each app requiring separate identity verification, users carry their credentials with them across the entire ecosystem.

Removing Privacy Friction: Confidential Transfers Made Simple

Most Token Extensions have achieved wide adoption, as seen with xStocks and PYUSD, which both depend on them for compliance, stock splits, and metadata. But the Confidential Balances (formerly Confidential Transfers) extension has remained underutilized despite solving a critical mainstream need: financial privacy.

Confidential Balances allow two parties to transfer tokens without revealing the full details of the transaction. While the fact that parties transacted remains visible, the amounts stay private - a critical need for purchases, wages, and investments.

When released, the technology promised a lot. While dedicated privacy-focused blockchains offer strong confidentiality, they lack general-purpose applications, effectively isolating privacy features from mainstream use. Confidential SPL Tokens were going to bring privacy to the applications people use.

However, adoption stalled due to implementation complexity: pre-creating accounts, token wrapping, and manual balance management made it impractical for regular applications - you can’t just enter a recipient address and transfer one of your existing tokens privately in a regular Solana wallet.

Arcium has built on Confidential Balances to create Confidential SPL Token, specifically allowing Solana program developers to integrate confidential transfers without having to set up recipient accounts or wrap tokens.

Together, these developments complete crypto's transformation from niche technology to invisible infrastructure. When onboarding is seamless and privacy is built in, the last arguments against crypto adoption disappear.

The progression is clear: boring infrastructure enabled exciting applications, which attracted mainstream users, who demanded better onboarding and privacy. Each layer builds on the previous one, creating a complete financial infrastructure that competes with-and increasingly surpasses - traditional alternatives.

Conclusion: The Quiet Revolution That Changed Finance

The Solana ecosystem in 2025 represents a fundamental shift that most people missed while it was happening. The transformation from blockchain experiment to financial infrastructure wasn't announced with fanfare - it is emerging through the accumulation of boring improvements that enabled exciting applications.

The evidence is everywhere when you know where to look:

Perfect network uptime isn't just a technical achievement-it's the foundation that lets institutions trust crypto with real money.

Token Extensions aren't just protocol features-they're the compliance and user experience capabilities that make crypto applications competitive with traditional finance. When PayPal integrates Solana addresses for 400+ million users, they're betting on this infrastructure while creating seamless banking integration for crypto.

S&M applications aren't just better crypto apps-they're applications that succeed by making crypto invisible. When users choose Lulo over traditional savings accounts, they're not adopting crypto; they're adopting better finance.

Looking ahead, Attestation service and confidential transfers aren't just technical innovations-they're solutions to the final barriers preventing universal adoption. They represent the completion of crypto's evolution from niche technology to mainstream infrastructure.

The pattern reveals crypto's maturation strategy: succeed by becoming invisible. The most revolutionary applications are those that users don't recognize as revolutionary. The new becomes indistinguishable from the normal, except better.

The question is no longer whether blockchain technology can serve mainstream financial needs. Solana's 2025 ecosystem proves it already does. When crypto stops looking like crypto, it stops being alternative finance and starts being just finance.

Follow @QuickNode on X for our latest Solana ecosystem reports and blockchain infrastructure insights.

QuickNode was one of the first commercial RPC providers to provide support for Solana. A YC funded startup itself, we're used by Solana giants like DRiP, Kraken, and Phantom. With a globally balanced infrastructure, guaranteed reliability, and end-to-end customer support, QuickNode allows enterprises to build their Solana products faster.