The Ultimate Intro To DeFi

Some of the most successful dApps on top of the Ethereum blockchain like MakerDAO/DAI, Compound, 0x (and more which are discussed below) aim to disrupt the current legacy financial services system .

Open and Decentralized Finance (DeFi) is the new hoot in the blockchain world.

Some of the most successful dApps on top of the Ethereum blockchain like MakerDAO/DAI, Compound, 0x (and more which are discussed below) aim to disrupt the current legacy financial services system and give rise to a whole new digital economy which will empower an average person to a superior degree of economic freedom.

First, let’s understand why we need DeFi…

Irrespective of how vital the current financial services infrastructure is, it is plagued with many problems. The root cause of all of the engendering problems is the presence of centralized, monolithic, siloed institutions. All the transactions taking place today using legacy infrastructure are under the umbrella of a third party. Essentially, this centralized third party can have a say in who would be provided with financial services and who would not be.

This is the first step where an individual’s economic freedom is taken away.

The working of these centralized institutions is bound by geographical barriers. It solely depends on a person’s luck if he/she was born in a developed country which would protect their individuality.

DeFi is here to eradicate the need to rely on chance to live life with full autonomy and freedom.

The current pitfalls of a typical legacy financial institution are:

- Discriminated access to financial services

- Full of censorship

- Afflicted with counterparty risk

- Clear lack of transparency

The implications of the above-mentioned pitfalls are serious:

- To make use of the legacy financial instruments, an excessively high fee is levied.

- Due to the lack of availability of assets due to geographical boundaries/ red tapism/ censorship, a person is unable to diversify his/her portfolio which makes him/her devoid of opportunities.

- Presence of unnecessary counterparty risk puts a person in a position of higher risk than required.

DeFi has the power to put an end to problems which the contemporary financial institutions face by leveraging P2P (peer-to-peer) finance. This is possible because of the advent of blockchain technology.

Now, let’s see how it can be done…

Since DeFi leverages the most popular DLT; the blockchain, DeFi becomes inherently superior to its legacy counterparts because of the following characteristics:

- Permissionless: Each individual will have free and fair access to all financial services.

- Censorship Resistant: Each individual will be entitled to use all kinds of financial instruments regardless of any other binding regulations.

- Programmable: Each and every contract will be pre-programmed and will be executed in the same manner for every individual.

- Transparent: The internal working of a contract would be clearly visible on the ledger thereby inducing transparency into the system.

- Trustfulness: Due to all of the above-mentioned characteristics, the overall system can be easily trusted by an average person.

DeFi enables an average person to be the master of their own funds and personal data. Since each contract is programmable, the risk of the counterparty is mitigated. DeFi also eliminates intermediaries from the value chain; consequently, there is a significant reduction in fee levied and time taken to complete a transaction. DeFi also enables people to generate a passive income out of the coin/token portfolio they currently own.

Evolution of DeFi

The primitive version of DeFi dates back to 2008. The credit for P2P cash definitely goes to Satoshi Nakamoto for engineering Bitcoin.

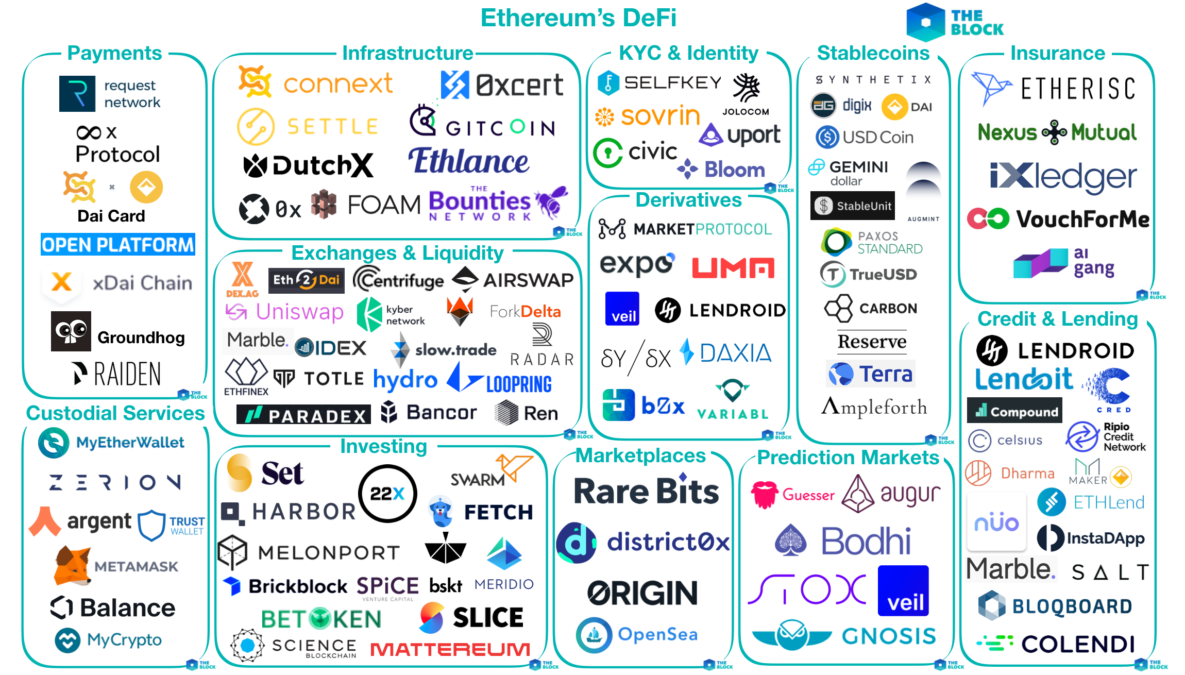

On the Ethereum blockchain, DeFi picked up in 2016 with dApps like:

- EtherDelta: Decentralized P2P trading platform for ETH and ETH-based (ERC20) tokens

- WeTrust: Financial inclusion leveraging DLT

- Etherisc: Decentralized insurance

But this was just the beginning!

In 2017, more DeFi projects started to emerge like:

- DAI: Decentralized stablecoin pegged to USD

- VariabL: Ethereum blockchain derivative trading platform

- EthLend: Decentralized lending

And here we are!

In 2018, DeFi dApps started to form an ecosystem with a variety of projects completing the financial services full circle:

- Augur: Decentralized prediction market platform

- bZx: Decentralized margin lending

- dYdX: Decentralized protocol for crypto derivatives

- Compound: Earn interest on and borrow crypto to invest, use, or short-sell

- Kyber Network: Decentralized token swap.

- MelonPort: Crypto asset management

- 0x: Decentralized exchange

- Dharma: Decentralized borrowing-lending marketplace. Dharma Lever is built on top of Dharma protocol.

- Loopring: Decentralized token exchange protocol. Dolomite.io, for crypto trading and management, is powered by Loopring.

- InstaDapp.io: Banking protocol which makes amalgamates different protocols. Example, it uses the Kyber network to swap ETH for MKR and then uses MakerDAO protocol.

An awesome list of DeFi projects, software, and resources can be found here.

Infrastructure for the New Digital Economy

Philosophically, the new age infrastructure is contingent upon the user adoption. Even though the number of DeFi projects is increasing, more investors are interested in the segment, and dev tools maturing, the concept of DeFi has limited adoption. It hasn’t gone mainstream — yet. Thinking from a user-centric point of view, there is a need for both usability (UX/UI) and scalability.

Technically speaking, scalability is codependent on the infrastructure. For example, the way Lightning Network is trying to power Bitcoin blockchain, State Channels are doing the same to Ethereum blockchain. Exploring layer 2 solutions has become a dire need since the throughput required is way beyond reality.

Another technical aspect to think about is robustness. QuickNode helps dApps to have a 24/7 uptime. Reliability is one of the most crucial features to consider while architecting a finance dApp. Having chain data available immediately, without any delay is equally crucial. QuickNode provides a conducive environment for the dApps to operate reliably with trustworthy, powerful, proven Web3 infrastructure.

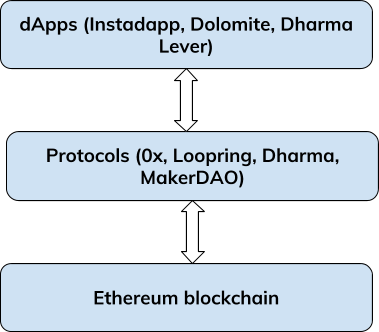

dApp Architecture for New Digital Economy

The dApps at layer 3 can make use of tools like QuickNode to stay competitive in the Ethereum blockchain network.

Closing Words

The DeFi dApp ecosystem is maturing at an astronomical pace. DeFi has the potential to go mainstream when interoperability of chains is addressed, scalability is enhanced, and usability (accessibility, key management, security, UI/UX, etc…) is improved. Web3 developer tools have come a long way. Access to fast, reliable Web3 infrastructure is no more a dream but a reality. Check out QuickNode for the same here. Lastly, the future of this newly found digital economy backed by DeFi would pose a more democratic world for the common man, where he/she would live with a true sense of financial freedom.

Need help with your project or have questions? Contact us via this form, on Twitter @QuickNode, or ping us on Discord!

About QuickNode

QuickNode is building infrastructure to support the future of Web3. Since 2017, we’ve worked with hundreds of developers and companies, helping scale dApps and providing high-performance access to 16+ blockchains. Subscribe to our newsletter for more content like this and stay in the loop with what’s happening in Web3! 😃