Which Blockchain To Build On

Understanding the use cases for each blockchain will help you decide which to build on.

Deciding which blockchain to use or build on can be difficult. Each blockchain comes with a set of primary use cases along with a built-in community and culture. It's important to take both of these constructs into account to select an ecosystem that is optimized for your specific use case...

Figuring out the initial scope of your project is a necessary first step in figuring out which blockchain to use. If you don't know how your project will leverage a specific blockchain, you'll be lost. So first, you must figure out your use cases.

Use Cases for Blockchain Technology

As author Simon Sinek says, "start with why." Remove the tech and start with the why. Below are some of the prominent use cases for blockchain technology. Understanding these use cases is key to choosing the right chain to build on.

Decentralized finance (DeFi)

DeFi has emerged as a leading alternative to more traditional financial services. Participants can make peer-to-peer financial transactions quickly on-chain. Rather than financial data hiding on a company server, all data is open on the blockchain.

Many of the traditional services offered by banks and centralized financial services have been made available via DeFi protocols — without the middleman. From lending, borrowing, and trading, these actions are now available to anyone with an internet connection while many times being faster, more transparent, and more secure.

Non-fungible tokens (NFTs)

NFTs jumped into popular vernacular in the last two years. NFTs allow for the tokenization of any form of media — from digital art to physical clothing to educational transcripts. What it means for something to have value is now backed by mathematical integrity.

We are just starting to scratch the surface of possible use cases for NFTs — including many real-world use cases like real estate, event tickets, personal identity solutions, and a digital footprint in real-time for supply chains that relieve a lot of the current pressures on paper trails and human error.

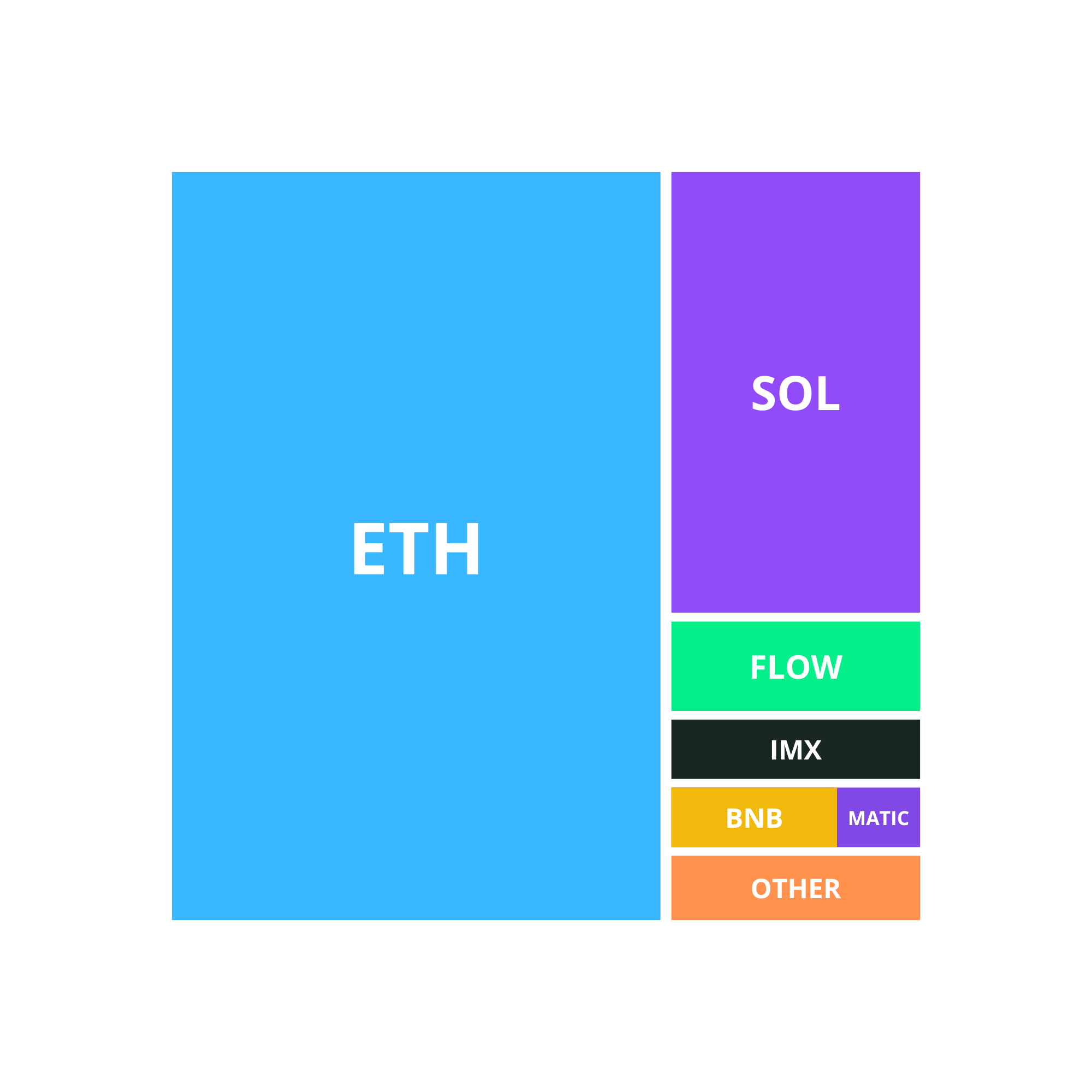

NFTs live on individual blockchains, for example: Ethereum, Solana, Arbitrum, Avalanche, Flow, ImmutableX, BNB, and Polygon. Most of the infrastructure built around NFTs relates to how users are able to transact and store them — from marketplaces like OpenSea and Magic Eden to digital wallets like MetaMask and Coinbase's native wallet.

NFTs went through a crazy bull market from 2020-2021, led by the likes of Bored Ape Yacht Club and CryptoPunks. While NFT trading volume has fallen, countless artists and builders are still creating NFTs and using NFT technology in their projects.

Decentralized storage (DeStor)

DeStor is a niche use case that has been rapidly growing. When picturing storage using traditional tools, most picture hardware offerings or cloud storage. Both are prone to data leaks and rely on centralized third parties.

The simplified and secure management of data through decentralized alternatives comes through the ability to store information on a decentralized database. No one entity holds your data completely — no more AWS shutdowns causing your SaaS product to go down for two hours.

A prime example of DeStor is IFPS. The Interplanetary File System (IPFS) is a revolutionary new protocol for storing and serving files. IPFS allows computers all over the globe to store and serve files as part of a giant peer-to-peer network.

Consumer Applications

Consumer Apps are starting to see the light as an influx of users onboard into daily use of blockchain technology. For example, music-streaming apps, messaging apps, and social networks have all been built using blockchain technology.

The interoperable nature of this technology has allowed for experiments around user-owed platforms. In the case of the up-and-coming social network Farcaster, founder Varun Srinivasan calls the platform "sufficiently decentralized." The app was built to feel like you're using Twitter with the blockchain tech nearly invisible.

Blockchains

Once you've got a use case, it becomes a lot easier to figure out which blockchain you want to build on. Remember, it's not just the technical aspect that matters. Each blockchain has a community of developers, creators, and builders working on the project.

Ethereum

Ethereum is currently the most popular blockchain for developers to build on. It was created by Vitalik Buterin and now has the second-largest market capitalization after Bitcoin. With conferences multiple timers per year, it has an incredible community of builders, developers, and users.

One of the main reasons for Ethereum's popularity is its smart contract functionality, meaning it can store programs on the blockchain which run automatically when predetermined conditions are met. Using smart contracts, builders created popular DeFi protocols like Curve Finance, DAOs like MakerDAO, and NFT collections like Bored Ape Yacht Club. With this lively ecosystem, Ethereum now has a Total Value Locked (TVL) of $31.9B.

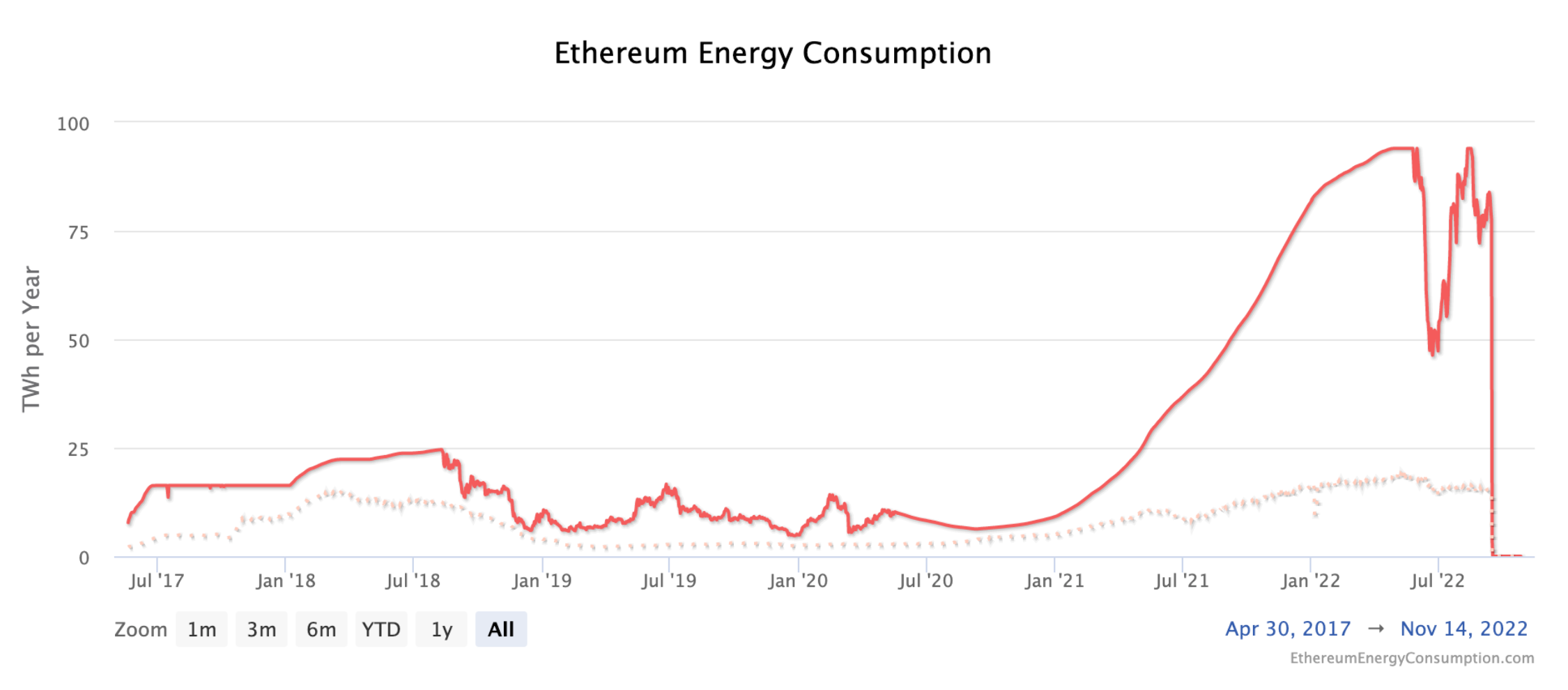

Ethereum recently transitioned from a Proof-of-Work (PoW) system to Proof-of-Stake (PoS). Without going into too much detail, PoS is a new system of validating transactions that decreased energy usage on Ethereum by 99.5%.

For developers, the journey to becoming proficient with building on Ethereum comes with a cost. Solidity is the native language and the only way to create smart contracts. While it's challenging, there are a plethora of tools out there to help developers: services like Truffle, which is a smart contract development, testing, and deployment framework, and EthHub, which provides a comprehensive overview of Ethereum.

While Ethereum has its advantages, it struggles with scalability, speed, and transaction costs. Due to these issues, Layer 2 blockchain protocols like Polygon, Optimism, and Arbitrum have been built on top of Ethereum using rollups — a method to speed up transactions and decrease prices by rolling up transactions on Layer 2 and then transmitting them back to Ethereum.

Solana

Solana is known to many as an "Ethereum killer" due to its speed of transactions, low costs, and flexibility. But with a whopping 16 outages in the last year, Solana has a mixed reputation.

Rather than needing a Layer-2 network like Ethereum, Solana's average transaction fees are $0.00025, while the average gas on Ethereum is typically much higher. This alone makes for a more accessible ecosystem for consumers and builders alike.

Solana can be defined as an open-source and programmable blockchain that operates using smart contracts called "programs." Smart contract development on Solana is done in Rust, C, and C++, making the developers' onboarding process more intuitive.

With hackathons and hacker houses around the globe, the Solana Foundation has a very supportive base of developers. They also provide developers with a crowdsourced collection of education courses and resources.

Solana has a busy ecosystem as well. With $1.3B in TVL, Solana is the chosen blockchain for popular NFT projects like DeGods and DeFi protocols like Solend. As of October 11th, 2022, it's the 5th largest blockchain in DeFi in terms of TVL.

Polygon

Polygon is a Layer-2 scaling solution or "sidechain" that runs on the Ethereum blockchain. Although it runs on Ethereum, Polygon has its own native currency called MATIC, which is used to pay for fees on the Polygon network, for staking, and for governance purposes.

Layer-2s like Polygon were created because Ethereum has such high gas fees and slow transaction times. Polygon is like the express train running next to the regular train on the subway. It uses rollups to bundle up transactions on Polygon and transmit them back to Ethereum. Like Ethereum, Polygon also uses a proof-of-stake consensus mechanism.

Because Polygon is a separate chain from Ethereum though, you need to bridge your ETH over to Polygon to use it. This sounds like a headache, but it's relatively easy and often worth it. Polygon's transaction fees are less than a penny per transaction, and the speed is nearly instantaneous.

For these reasons, Polygon is wildly popular in DeFi with a $1.27B TVL. What is more impressive is the sheer amount of big-name partnerships the Polygon team has landed. It's become the chain of choice for companies like Reddit, Meta, Behance, and Mercedes-Benz.

Decisions, Decisions

Is it the right idea, wrong time? Many blockchain-related products have fizzled out due to a lack of community around the blockchain that they were built upon.

When choosing a blockchain, the main factors include the number of active users, level of centralization, and developer ecosystem. As with any early-stage technology, the number of users within the ecosystem that you're developing in is crucial.

The number of users also seems to dictate the overall ease of use. Some underdeveloped blockchains might check all of the boxes technology-wise, but may not have enough infrastructure built around them for your product to be successful.

Depending on your project, the level of centralization is also a factor to consider as blockchains are either public networks, permissioned networks, or private networks. As with many sectors at the edges of technology, developers can be hard to come by.

If this is pertinent to your project, it's best to go where the builders are most abundant. The blockchains mentioned above are just a few of the options available, so be sure to do further research before coming to a conclusion.

About QuickNode

QuickNode is building infrastructure to support the future of Web3. Since 2017, we've worked with hundreds of developers and companies, helping scale dApps and providing high-performance access to 15+ blockchains. Subscribe to our newsletter for more content like this and stay in the loop with what's happening in Web3!