Digital Asset Custody: Ensuring Low-Latency, Secure Trade Execution at Scale

Discover how custodians can achieve ultra-fast, MEV-protected crypto trade execution using enterprise-grade blockchain infrastructure. Learn the architecture, risks, and solutions that power secure, real-time digital asset trading at scale.

By leveraging dedicated global blockchain infrastructure and direct on-chain connectivity, custodians can execute digital asset trades in real time with uncompromised security and reliability. This enables institutions to meet performance demands (where every millisecond counts) while upholding strict compliance and risk controls in their trading workflows.

The rise of institutional crypto adoption and on-chain trading volumes (e.g. $27 trillion in stablecoin transactions settled in the first 11 months of 2024) has made it clear that speed, security, and reliability are non-negotiable for digital asset custody operations. Compared to traditional finance, on-chain trades introduce unique challenges: transactions must propagate through decentralized networks, compete in public mempools, and withstand risks like front-running by bots. In this guide, we’ll explore what it takes to build a low-latency, secure trading architecture for custodians and outline a technical blueprint to achieve it.

What’s really important?

First, three essential criteria must be met by any institutional digital asset trading stack:

- Low-Latency Execution: The end-to-end time from trade initiation to blockchain inclusion should be minimized. In fast-moving markets, delays of even a few seconds can lead to missed opportunities or slippage. High latency not only degrades user experience but also creates windows for information arbitrage – slow transaction propagation can enable bots or competitors to front-run your trades. A custodian’s infrastructure needs to broadcast transactions immediately and fetch on-chain data in real time, ensuring that their view of the market is always up-to-date.

- Security & MEV Protection: Custodians must ensure that transactions are executed with integrity and aren’t compromised in transit. In practice, this means protecting trades from MEV (Maximal Extractable Value) attacks like front-running or sandwiching, which exploit the public mempool by reordering or inserting transactions for profit. For high-value on-chain trades, using private transaction relays or specialized RPC endpoints can keep transactions hidden from predators until they are confirmed, preventing malicious actors from tampering with the order flow. (For example, QuickNode’s MEV Protection add-ons provide a private RPC that shields transactions from MEV attacks.) Security also encompasses data integrity—direct connectivity to blockchain nodes (without unreliable intermediaries) ensures the transaction and state data you rely on is exactly what’s recorded on-chain.

- Reliability & Global Reach: In a global trading environment, uptime and geographic distribution are critical. Custodial platforms often serve clients around the world and operate 24/7, across multiple blockchains. The infrastructure must handle high volumes without faltering—every trade request should go through, even during traffic spikes or network congestion. Redundancy and failover are a must for high availability. Additionally, a globally distributed network of node infrastructure can route requests to the nearest region, reducing latency for users in different locales. Consistent performance and up-to-date nodes (always synced to the latest block) are required so that trades aren’t delayed waiting for a node to catch up. In short, the platform should be as reliable and fast as the underlying blockchain (if not more so), with no single points of failure.

A robust custodial trading setup must satisfy these criteria to execute orders swiftly (often in sub-second timescales), protect each transaction from adversarial conditions, and ensure operational continuity. Failing to meet any one of these can result in financial loss or compliance breaches – for instance, an outage when the market is moving or a front-run trade violating best execution policies.

What are the options?

This is one of the first considerations when engineering a low-latency trading system for digital assets: how will you connect to the blockchain networks to read data and send transactions? There are several approaches, each with trade-offs against our criteria (speed, security, reliability):

1. Self-Hosted Nodes

Running your own blockchain nodes gives you direct access to the network without third-party dependencies. On paper, this should maximize control: you can configure nodes as you like and ensure data comes straight from the source (meeting integrity needs). However, the practical challenges of self-hosting at scale are significant. For a custodian dealing with multiple chains and global clients, you would need to deploy many nodes across regions and maintain them around the clock. Ensuring low latency is not just a matter of running a node; it requires optimizing network peering, hardware, and proximity to validators/miners – tasks that demand specialized expertise. Moreover, maintaining high reliability can become an operational quagmire: nodes require constant updates (forks, upgrades) and monitoring, and any downtime directly impacts your business. As one industry provider discovered, self-hosting blockchain infrastructure is resource-intensive and distracts from core business – “maintaining blockchain nodes would be resource-intensive” – especially when zero downtime is expected by institutional clients.

Crucially, a lone self-hosted node (or even a small cluster) might struggle to meet low-latency requirements consistently. If your node is in a single region, users far away will experience added network latency. Spinning up nodes in multiple continents and keeping them all in sync is a non-trivial endeavor. There’s also the question of throughput and scaling: if your trading volume spikes or you need to query many pieces of data in parallel, can your self-run infrastructure handle it? Without significant over-provisioning or dynamic scaling, you risk hitting performance bottlenecks or rate limits during peak times. In summary, while self-hosting provides raw access, it tends to fall short on global low-latency coverage and requires heavy lifting to achieve the level of reliability and responsiveness a custodian needs.

2. Public or Basic RPC Endpoints

Another route some teams explore is using public RPC endpoints or free infrastructure services provided by blockchain projects and aggregators. For example, decentralized exchange aggregators might offer a public API for submitting swaps, and some blockchains run public nodes that anyone can query. The appeal here is zero setup and low upfront cost – you leverage an existing endpoint and avoid running your own nodes. However, these public or shared services come with strict limitations. They often enforce rate limits, multi-tenant performance constraints, and unreliable uptime. In the context of low-latency trading, relying on a congested public endpoint is risky: you might experience variable response times depending on how many others are using it. Indeed, the “convenience” of a free API usually comes at the cost of speed and consistency. For instance, a public swap API might throttle your requests or have a p99 latency of a couple of seconds – far too slow when millisecond-level decisions matter.

Security is another concern. Public endpoints typically do not offer MEV protection or specialized transaction handling. Your transactions go through the public mempool like everyone else’s, increasing the chance that a predatory bot sees and acts on them. There is also a lack of customizability – you can’t easily integrate bespoke workflows (such as custom failover logic or priority routing) when you’re at the mercy of a basic provider. In short, while public RPC endpoints might be fine for hobby projects or initial testing, they fail to meet the bar on all three criteria for an enterprise-grade custody platform. High-frequency trading bots and mission-critical systems quickly outgrow these solutions due to their latency and reliability issues.

3. Enterprise-Grade Node Infrastructure

The third option is to use an enterprise-grade node infrastructure provider. QuickNode, for example, offers two main services to address varying institutional requirements: the Core API and Dedicated Clusters.

- Core API: QuickNode’s Core API provides high-performance RPC endpoints distributed across numerous regions globally. With a broad and extensive network, it ensures consistently low latency and reliable blockchain connectivity. This widespread global coverage benefits custodians requiring immediate transaction propagation and responsive data fetching without the overhead of custom node management. Custodians utilizing Core API gain instant access to optimized routing, caching, and high-availability infrastructure tailored for mass-scale blockchain interaction.

- Dedicated Clusters: For custodians needing customized, isolated environments, QuickNode offers Dedicated Clusters. This service provides fully dedicated node resources—eliminating "noisy neighbors"—alongside customizable configurations such as client-specific settings, precise regional deployments, and additional redundancy units. Dedicated Clusters ensure predictable high performance tailored to specific latency or regulatory needs, giving institutions granular control over their node infrastructure setup.

Both Core API and Dedicated Clusters address critical enterprise criteria:

- Low Latency: QuickNode’s optimized networking and global node distribution ensure minimal delay by routing requests to the closest node available.

- Security & MEV Protection: Both services offer integrations like private RPC endpoints and specialized transaction relays (e.g., Merkle) to protect against front-running and MEV exploitation, allowing custodians to securely send transactions directly to validators.

- Reliability & Redundancy: QuickNode maintains redundant systems and automatic failover mechanisms to guarantee high availability. Dedicated Clusters provide additional redundancy options customized by client specifications.

In essence, a professional infrastructure provider can satisfy all the needs of a custodial trading platform: ultra-fast execution, advanced protections, and always-on availability. This is why many leading fintech and crypto companies choose not to reinvent the wheel here. For example, Metaco (a digital asset custody tech firm serving Tier-1 banks - acquired by Ripple) switched to QuickNode after finding other solutions inadequate – QuickNode’s “lightning-quick response times and superior reliability” allowed them to meet clients’ expectations for speed, data quality, and uptime. Partnering with an expert provider gives you immediate access to a battle-tested network and a support team that can assist when issues arise, which is invaluable when you’re entrusted with safeguarding and transacting billions in assets.

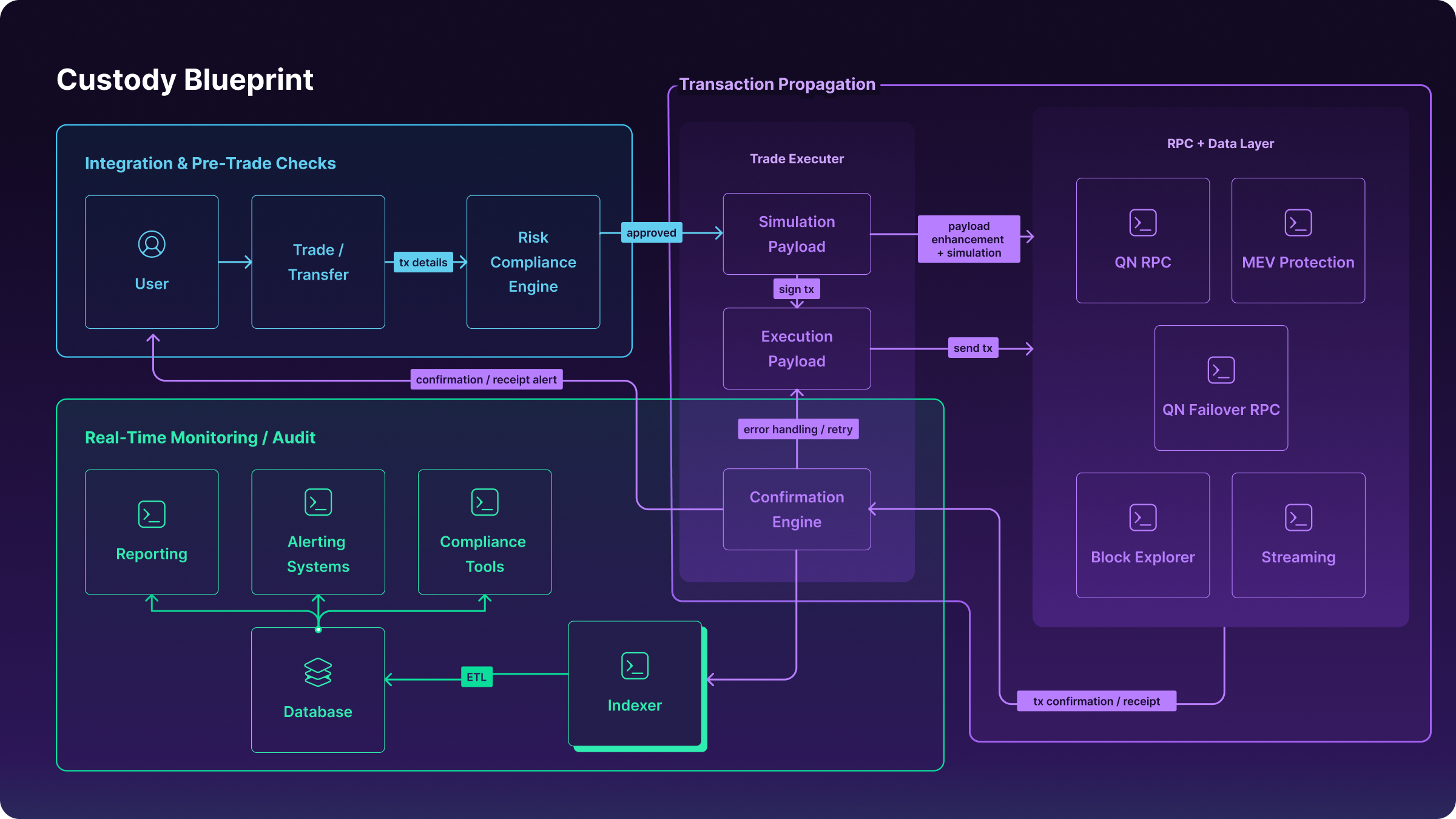

System Architecture Overview

Let’s assume you choose an enterprise-grade approach and want to design the end-to-end system for secure, real-time trade execution in a custodial context. Below is an expanded look at how each component can fit together, from trade initiation all the way to on-chain confirmation and audit. (This builds upon the reconciliation architecture from our previous guide, but here our focus is on the transaction execution pipeline rather than post-facto balance tracking.)

1. Integration and Pre-Trade Checks

Order Origin & Policy Controls: Institutional custodians typically integrate trading operations with internal compliance and risk management systems. When a trade or transfer is initiated (whether by a client through an interface, or by an internal trading desk), it first passes through policy checks. Compliance engines and risk management modules ensure the transaction complies with regulations and internal rules: for example, verifying KYC/AML status of addresses, checking that the size of the trade is within limits, and that the assets are available. These systems may interface with a custodial wallet platform (such as an HSM-based key management system or a service like Fireblocks/Copper) that holds the private keys and can create and sign the transaction. Only after a transaction request is approved by all necessary checks (and possibly multiple signatories in a multi-approval flow) is it released into the execution pipeline.

Real-Time Coordination: Once a trade is green-lit, a dedicated internal service (let’s call it the “Trade Executor” microservice) takes over to handle on-chain execution. This service receives the details of the transaction (asset, amount, from/to addresses, etc., or perhaps a swap instruction like “swap X for Y”). Its job is not to decide whether the trade should happen (that’s already decided by the business logic above), but to ensure it happens quickly and correctly on-chain. The Trade Executor interfaces both with the wallet/custodian system to obtain a signed transaction (if one isn’t pre-prepared) and with the blockchain network via RPC. At this stage, every millisecond saved counts – the service will timestamp the order and immediately proceed to broadcast it through the fastest possible route.

2. Transaction Propagation & Execution

Primary and Failover RPC: To broadcast the transaction to the blockchain, the Trade Executor uses a primary RPC endpoint provided by the infrastructure provider (e.g. a QuickNode HTTPS or WebSocket endpoint). This RPC connection is essentially our gateway to the blockchain. Because we’re using an enterprise provider, we have a dedicated cluster endpoint with low latency and high throughput. The system is configured with a failover RPC as well – either an alternate endpoint from the provider in another region or a secondary provider entirely – to ensure redundancy. In practice, the transaction is first sent to the primary RPC node via a method like eth_sendRawTransaction (for Ethereum) or the equivalent in other chains. The node immediately validates and relays this transaction to its peers in the network.

Global Mempool Broadcast: One advantage of using a globally optimized provider is that your transaction propagation can be near-instant across the world. QuickNode’s infrastructure, for example, peers with nodes in all major regions, meaning once your transaction hits their node, it quickly fans out to miners/validators wherever they are. Low propagation delay increases the likelihood that your transaction will be included in the very next block of the chain. It essentially reduces the “hop distance” between your custodian’s system and the block producers. The result: faster inclusion and lower risk of getting stuck in the mempool. Furthermore, the provider’s nodes maintain very high block recency– they are always aligned with the latest block height – so there’s no lag in recognizing the latest state (which could otherwise cause a transaction to be rejected due to referencing old state).

MEV and Front-Run Protection: For certain sensitive trades, the Trade Executor can choose a specialized broadcast method. For example, if executing a large DeFi swap on Ethereum, instead of the normal public mempool route, it could use a private transaction RPC. Our infrastructure provider supports this via an add-on: the transaction is sent with a method such as eth_sendPrivateTransaction which keeps it out of the public gossip network. This guarantees that no front-running bot even sees the transaction before it’s mined, effectively nullifying the risk of sandwich attacks or other MEV exploits. The trade-off is that these private routes might only work with certain miners or have slightly different inclusion guarantees, so the logic might fall back to the public route if needed (which is why having failover paths is important). Still, for a custodian executing an on-chain swap on behalf of a client, this kind of front-run protection can be the difference between getting the expected price or being victim to a costly sandwich attack.

Example – On-Chain Swap Workflow: To make this concrete, consider an enterprise performing an on-chain token swap on Solana for portfolio rebalancing. The Trade Executor could leverage an aggregator like Jupiter to get the best price route for the swap. With QuickNode’s integrated Metis Jupiter Swap API, the custodian can retrieve a swap quote and submit the swap through a high-performance backend that’s 4–5× faster than the public API. The signed swap transaction is then broadcast via QuickNode’s Solana node, reaching validators with minimal delay. Because of the low latency and dedicated throughput, the swap has a very high likelihood of being executed in the next Solana block, and the enterprise achieves near-instant execution of a large trade at the optimal price. This illustrates how each piece – from smart order routing to fast RPC broadcast – comes together to serve the custody use case. In sum, transaction propagation in our architecture is designed to be as direct and accelerated as possible, with fallback and protection mechanisms to handle the tricky aspects of blockchain trading.

3. Real-Time Monitoring and Data Layer

Confirmation and Streaming: After the transaction is submitted, the system shifts to monitoring mode to confirm that the trade has been mined/validated on-chain. Instead of simply polling the blockchain for a transaction receipt (which is workable but inefficient), our architecture can use a streaming or webhook mechanism. For instance, QuickNode’s Streams or enhanced WebSocket subscriptions allow the platform to listen for specific events – such as the appearance of our transaction hash in a new block, or a particular address’s balance change – and get notified the instant it happens. The Trade Executor service subscribes to these events (often set up beforehand, when the transaction was sent) and thus knows within a second (or less) when the trade is confirmed. This real-time feedback is crucial for a custodian’s workflow: it triggers downstream processes like updating position records, notifying users, or initiating any follow-up actions (e.g. releasing a fiat payment once a crypto transfer is confirmed).

Data Integrity Checks: Even though we trust our direct node connection, it’s good practice in enterprise systems to perform sanity checks, especially for critical transactions. The monitoring component might cross-verify the details via an additional source if available – for example, checking a block explorer API to ensure the transaction is indeed in the canonical chain (this can be helpful in edge cases like chain re-orgs). In most cases, though, the node’s confirmation is final. The platform then fetches any relevant resulting data: new balances, updated token holdings, etc., directly via RPC to record the post-trade state. If the trade was a swap, the amounts of each asset before and after can be pulled to confirm the swap output matches expectations. All of this on-chain data retrieval leverages the RPC layer, possibly using an internal indexer for efficiency if the volume of data is large. (Many custodians maintain an indexing service that continuously ingests blockchain data into a queryable database. This can speed up queries for historical data or aggregate positions, which is useful for both reconciliation and real-time risk management.)

Error Handling and Alerts: In the event a transaction fails to confirm (e.g., dropped from the mempool, or reverted due to a smart contract error), the monitoring layer will detect the absence of a confirmation within a expected timeframe. It can then flag this to operators or automatically retry as appropriate. Alerts might be sent to an SRE team if, say, the failure rate goes above a threshold or if a specific high-value trade fails. The system should gracefully handle such failures – for example, by reverting the internal state if needed or queuing the transaction for manual review. Having robust data on each transaction attempt (timestamps, node responses, error codes) is important for later analysis, which brings us to the final component.

4. Audit Trail and Feedback Loop

Every step of the process above generates log entries and audit data. These feed back into the custodian’s governance, risk, and compliance (GRC) systems.

Audit Trail: Each trade is recorded with details like who initiated it, when it was approved, how it was routed (e.g. via private RPC or public), and the eventual on-chain transaction ID and outcome. This complete audit trail is essential not only for internal accountability but also for external regulatory compliance. Custodians may be required to prove best execution and demonstrate that they took necessary precautions (e.g., prevented unauthorized transfers, avoided conflicts of interest in order routing, etc.). The logs from the Trade Executor, node responses, and confirmation data together form the evidence for such inquiries.

Risk Monitoring: The post-trade data (updated balances, etc.) flows into risk systems to recalibrate exposures in real time. If the trade was part of a larger strategy (for instance, moving assets to rebalance a portfolio or to provide liquidity somewhere), those systems will update dashboards and risk models accordingly. In fact, many custodial trading platforms have continuous risk checks that run even after execution – for example, ensuring that after a series of trades, the overall portfolio still aligns with limits, or that any outstanding unsettled transactions are tracked. The real-time on-chain data provided by the infrastructure (via streams or indexer) makes this possible by giving up-to-the-second state views.

Continuous Improvement: Finally, the feedback loop includes reviewing performance metrics and issues. Because we are using an external provider for the node layer, we keep an eye on metrics like RPC latency, success rates, and failover occurrences. Enterprise providers often supply dashboards or logs for this. Over time, analyzing these logs can reveal patterns – perhaps certain times of day see latency spikes on a particular network, or certain transaction types take longer. This information helps in fine-tuning the system. For example, if we notice that using a private relay significantly improved outcomes for large swaps, we might route more trades that way. Or if a certain RPC region is faster for a particular blockchain, we might reconfigure our primary endpoint accordingly. This continuous feedback ensures the trading architecture becomes more robust and efficient with each cycle, all while maintaining the compliance and audit standards required.

Fast, Secure, and Reliable—At Scale

Bringing it all together, this architecture empowers custodians to execute digital asset trades with speed, security, and reliability at scale. By combining real-time blockchain connectivity (via optimized RPC nodes) with strong pre-trade controls and post-trade verification, institutions can confidently operate in the crypto markets without sacrificing compliance or safety. Crucially, the use of dedicated, globally distributed infrastructure ensures that every transaction – from a routine transfer to a large multi-chain swap – is handled with minimal latency and maximum uptime. The outcome is a win-win: traders and clients get faster execution and better price outcomes (thanks to low-latency and MEV-protected transactions), while the organization maintains a complete, auditable record of activity and robust operational resilience.

In an environment where blockchain networks and markets run 24/7, having a trusted infrastructure partner becomes a force multiplier. QuickNode, for instance, has helped dozens of financial institutions and Web3 teams build these high-performance custody solutions. Its platform offers the building blocks for lightning-fast, globally reliable blockchain interactions – from RPC nodes that average <100ms response times globally to one-click add-ons for enhanced trading APIs and private transaction submission. With such capabilities, your team can focus on business logic and customer experience, while leaving the heavy lifting of node management and optimization to the experts.

Ready to accelerate your digital asset operations? With the right architecture in place, you can trade at the speed of blockchain (and sometimes even faster!). To explore a tailored infrastructure solution for your use case, feel free to reach out for a no-obligation consultation with our experts. In the world of digital asset custody, the winners will be those who execute swiftly, securely, and at scale – and the time to start building that capability is now.

About QuickNode

Since 2017, QuickNode has been dedicated to building infrastructure for the next generation of Web3. Serving thousands of developers and businesses, QuickNode offers lightning-fast RPC access to over 70+ blockchains.

Stay ahead of the curve by subscribing to our newsletter—get insights, guides, and the latest blockchain news delivered straight to your inbox. Join us in shaping the future of decentralized technology, one block at a time.